Our Mission & How We Help Individuals Live Debt Free

Money Fit by DRS offers a variety of debt relief programs to consumers in order to help them establish a solid financial future by eliminating their current challenges.

Trending Topics

As a nonprofit organization, our focus is on preventing financial issues and helping individuals develop strong core competencies in personal finance. Our Credit Counseling Services & Personal Finance Education programs provided through the Money Fit Academy are free to participate in.

Non-Profit

Money Fit is a nationwide nonprofit resource for consumers to turn to for trusted guidance and help on the road to their financial goals.

Financial Education

Our Credit Counseling Services & Personal Finance Education programs provided through the Money Fit Academy are free to participate in.

Debt Relief

We have excellent working relationships with thousands of creditors, many of who want the same, for their customers to overcome their current challenges.

Consumers that qualify for participation in our debt relief program, in which we consolidate unsecured debt into one monthly payment, typically find our fees for our debt management program reasonable and valuable.

Also, we offer 100% free debt relief for military service members at no cost to active duty military members. For businesses and organizations that partner with Money Fit to provide Financial Wellness benefits to their employees or members, the fees are drastically reduced.

You can learn more and receive your free consultation by calling our toll-free number at (800) 432-0310 or submitting your information through our website.

Who We Help

Money Fit offers help to households in financial crisis as well as individuals, couples, college students, seniors, and all others hoping to find trusted educational and counseling programs for their personal finances.

From debt reduction and credit building to budgeting and saving for emergencies, Money Fit is a nationwide nonprofit resource for consumers to turn to for trusted guidance and help on the road to their financial goals.

While Money Fit clients come from all walks of life and each has had unique experiences that led them to our services, the following characteristics are the most commonly shared:

-

Our clients are generally employed earning sufficient income to repay their debts if only their creditors would lower their interest rates and stop charging late and over-limit fees. Others we help may not have full-time employment, but they have regular income from social security, disability, pensions, settlements, or other steady resources.

-

We often find that those seeking our assistance have recently ended a period of unemployment, undergone some major medical procedures, gone through a difficult divorce, or even lost an expensive lawsuit. Consequently, they are saddled with thousands, often tens of thousands, and in some cases hundreds of thousands of dollars of debt.

-

We are also happy to help individuals, from new adults to seniors and everywhere in between, deal with any consequences of periods of impulse spending, unexpected or unplanned major purchases, or just plain overspending. Such individuals and couples never find reproachful or condescending counselors but only support, resources, and services to help them re-establish their finances.

-

The backbone of our services is a debt management program that helps consumers repay 100% of their unsecured debts. Individuals and households concerned with or struggling to meet their monthly payment obligations on credit card debts, medical debts, collection accounts, old utility, cell phone bills, and even payday loans will find direct and beneficial services through our certified credit counselors.

-

Consumers dealing with credit cards that carry high-interest rates (anything above the national average of 14% to 17% APR) can find relief through creditor concessions negotiated by Money Fit.

-

We often find that those seeking our assistance have recently ended a period of unemployment, undergone some major medical procedures, gone through a difficult divorce, or even lost an expensive lawsuit. Consequently, they are saddled with thousands, often tens of thousands, and in some cases hundreds of thousands of dollars of debt.

-

We are also happy to help individuals, from new adults to seniors and everywhere in between, deal with any consequences of periods of impulse spending, unexpected or unplanned major purchases, or just plain overspending. Such individuals and couples never find reproachful or condescending counselors but only support, resources, and services to help them re-establish their finances.

-

The backbone of our services is a debt management program that helps consumers repay 100% of their unsecured debts. Individuals and households concerned with or struggling to meet their monthly payment obligations on credit card debts, medical debts, collection accounts, old utility, cell phone bills, and even payday loans will find direct and beneficial services through our certified credit counselors.

-

Consumers dealing with credit cards that carry high-interest rates (anything above the national average of 14% to 17% APR) can find relief through creditor concessions negotiated by Money Fit.

Why We Do It

We’ve helped thousands upon thousands of consumers, perhaps like yourself, not only overcome their current debt-related issues but to equip them with the skillset and knowledge to prevent the event from happening again. While this may sound harsh, the reality is that once we’ve counseled an individual and aided them in fulfilling their debt obligations, we never want to see them again unless it’s to provide additional educational materials. It’s our charter, our vision, and what we stand for.

We have excellent working relationships with thousands of creditors, many of who want the same, for their customers to overcome their current challenges and to successfully manage their finances in the future, without the need for additional help.

Education First

Everything we do at Money Fit by DRS revolves around educating our clients and communities. In establishing Debt Reduction Services as a 501(c)3 nonprofit agency back in the 1990s, our founder identified financial education as our chartered nonprofit purpose. Our debt counselors’ first obligation is to help the client put together and understand a workable household budget. Every counseling session includes a referral sheet to financial education resources applicable to the client, whether these include our own workshops, webinars, and online materials or those of government and other community organizations.

We long ago committed to our clients, funders, and even regulators that we would always offer financial education programs, resources, and materials at no cost to anyone meeting with us by phone, in person, or electronically.

Finally, we have developed scores of webinars and workshops that our educators and managers have facilitated over the years for tens of thousands of community members in churches, schools, jails and prisons, and even businesses and other nonprofit agencies.

Find Money Fit on Our Social Medias!

Keep up-to-date with Money Fit by following us on Social Media! So, please take just a minute to follow us on social media. We are very active on various social media platforms.

Each offers you the quick and easy chance ask us questions, get updates about new blog articles, and receive practical finance tips and tricks that will likely interest you in your current situation. We would love it if you would consider sharing our social media account information with your family members and friends who might be interested in a better financial life.

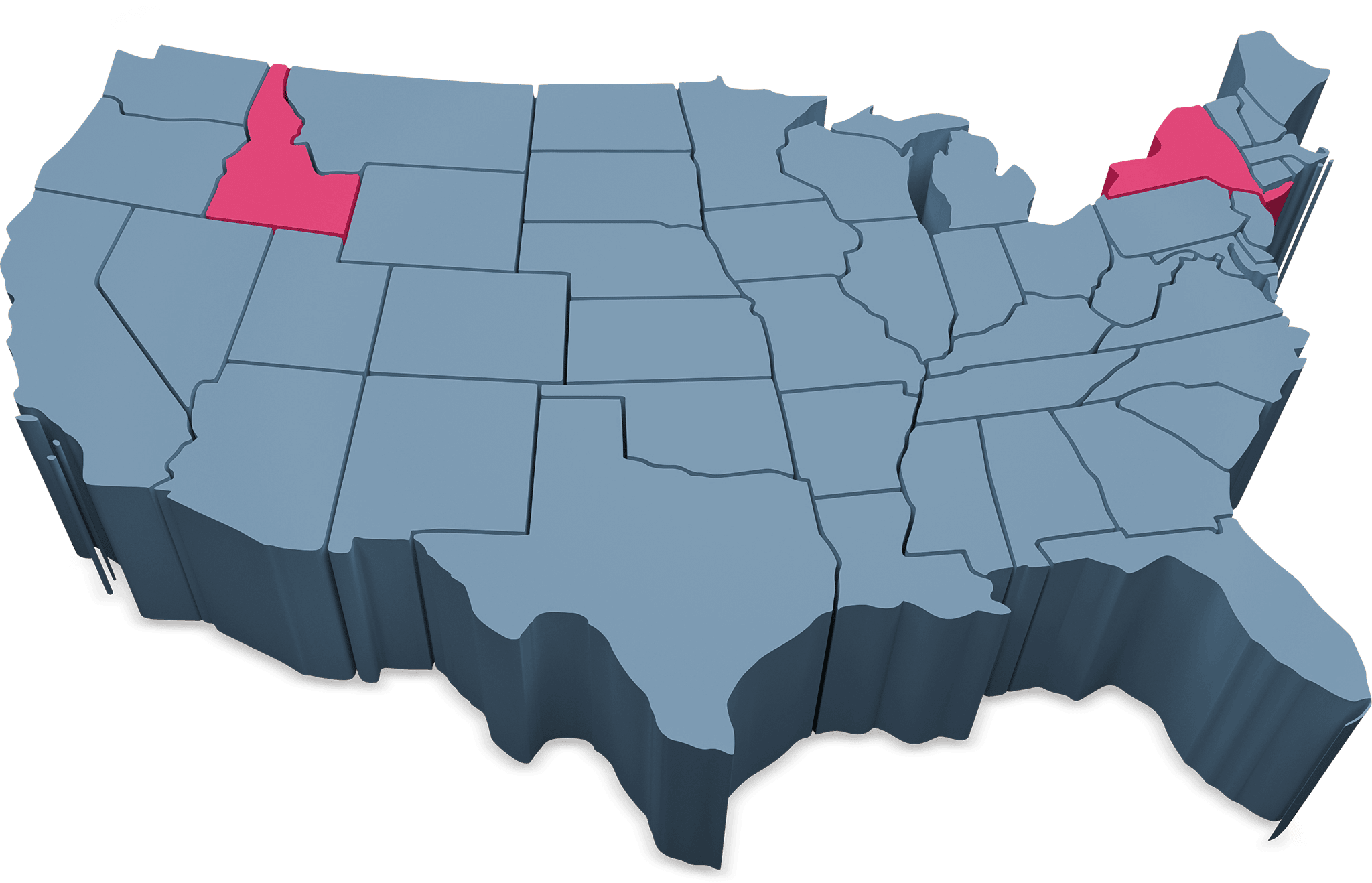

Where We Operate

Money Fit by DRS is licensed or registered to provide nonprofit credit and debt counseling to residents in all 50 States of America as well as the District of Columbia. We have office locations in New York, and Idaho, and we provide phone and internet counseling in all locations we operate in. We provide face-to-face consultations in areas where we have a physical location.

Money Fit In The News

We’ve been fortunate to continue to be published in major media outlets such as Mint.com, Huffpost, CreditCards.com, Fair.com, AARP & many more.

For a list of all media & news mentions, please visit: