Credit Card Debt: Your Roadmap to Financial Freedom

With the rise of cashless transactions, credit cards have become an indispensable tool for many. Yet, they also represent one of the most common financial burdens people face. Welcome to the definitive guide on understanding credit card debt and the paths you can take towards a debt-free future.

At Money Fit, we specialize in helping individuals manage all forms of unsecured debt, but our core expertise lies in addressing the unique challenges of credit card debt.

Table of Contents

Navigate through our comprehensive guide on credit card debt to better understand, manage, and overcome the financial challenges it poses. Click on any topic to jump to that section.

Understanding Credit Card Debt: Causes, Effects, and Solutions

The Anatomy of Credit Card Debt

The Rise of Credit Card Usage

Credit cards, once a luxury, have now become a modern necessity. Their convenience, the rewards programs, and the ability to make big-ticket purchases have catapulted their popularity. But with this convenience also comes a hidden snare – the ease of accumulating debt. In 2023, according to the Federal Reserve of New York, the average household has accumulated $7,951 in credit card debt, a 44% increase from just a decade ago.

How Debt Accumulates: The Cycle of Borrowing

Every swipe of a credit card is essentially a loan. If not paid off in full by the due date, interest is added to the principal, causing the owed amount to grow. Over time, minimum payments, combined with new purchases, can set a consumer on a treadmill of perpetual debt. Especially when one considers the average APR (annual percentage rate) of credit cards hovers around 21% as of the third quarter of 2023.

Causes of Credit Card Debt

Living Beyond Means

One of the most common reasons for spiraling credit card debt is spending more than one earns. Tempting advertisements, societal pressures, or simply not keeping track of expenses can lead to this financial pitfall.

Unexpected Medical Bills

Even with insurance, medical emergencies can lead to hefty bills. Many people turn to credit cards as a solution, but without a plan for repayment, this can result in long-term debt.

Lack of Financial Literacy

Often, individuals aren’t taught how to manage finances or understand the implications of credit card interest rates and minimum payments. A lack of financial education can inadvertently lead to accumulating and maintaining debt.

Effects of Credit Card Debt

Psychological Impacts

Debt isn’t just a financial burden; it weighs heavily on one’s mental well-being. Anxiety, stress, and even depression can be linked to sustained financial pressures.

Financial Consequences

Long-term credit card debt can lead to reduced savings, inability to invest for the future, or even bankruptcy. It’s a cycle that can impact one’s financial health for years or even decades.

Long-Term Credit Score Implications

Consistently carrying a high balance or missing payments negatively affects credit scores. A low score can lead to higher interest rates on loans, difficulty in securing mortgages, or even challenges in finding a rental apartment.

Strategies for Managing Credit Card Debt

Budgeting and Expense Tracking

Understanding where your money goes is the first step. Implementing a strict budget and tracking every expense can help reign in unnecessary spending and allocate funds to repay debt.

Debt Consolidation Options

For those with multiple cards or high-interest rates, consolidating debt can be an option. This means combining all debts into one loan, often with a lower interest rate, making it easier to manage and repay.

Seeking Professional Financial Counseling

Organizations like Money Fit offer guidance to individuals overwhelmed with debt. Expert advice, tailored strategies, and financial education can pave the way to a debt-free life.

Success Stories:

Triumph Over Credit Card Debt

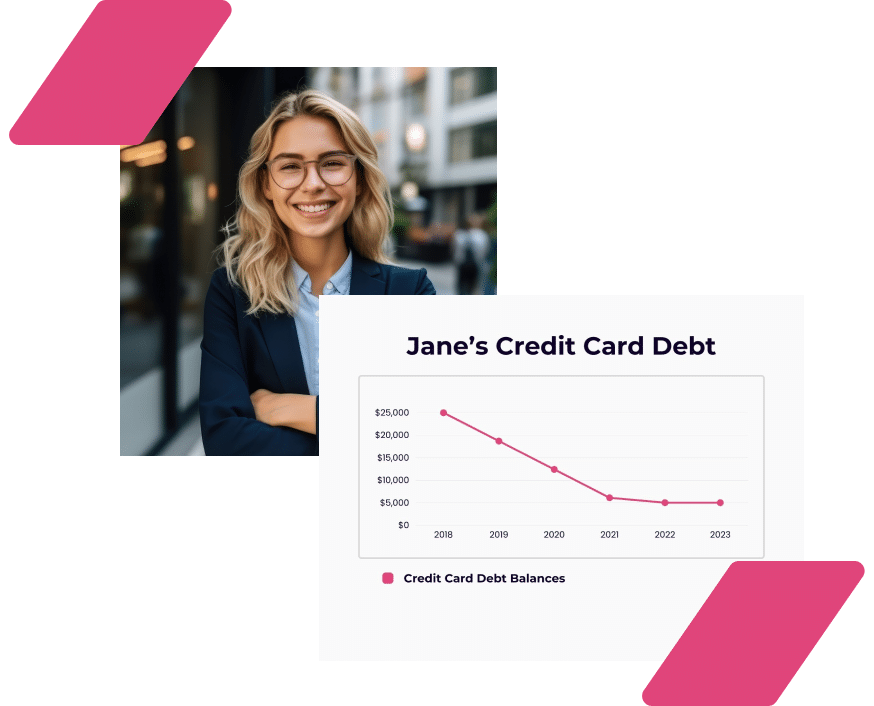

Jane's Journey: From Overwhelming Debt to Financial Freedom

Before: Jane, a 32-year-old marketing professional, found herself buried under $25,000 in credit card debt. A combination of unexpected medical bills, impulsive shopping, and not being financially literate played a significant role in her growing debt.

The Turning Point: Jane reached out to Money Fit, seeking guidance on managing her spiraling finances. Our team helped her with budgeting, expense tracking, and introduced her to the concept of debt avalanche to tackle her highest interest rates first.

Outcome: Within two years, Jane managed to clear 80% of her debt. Today, she’s not only debt-free but also champions financial literacy in her community, ensuring others don’t fall into the same traps she did.

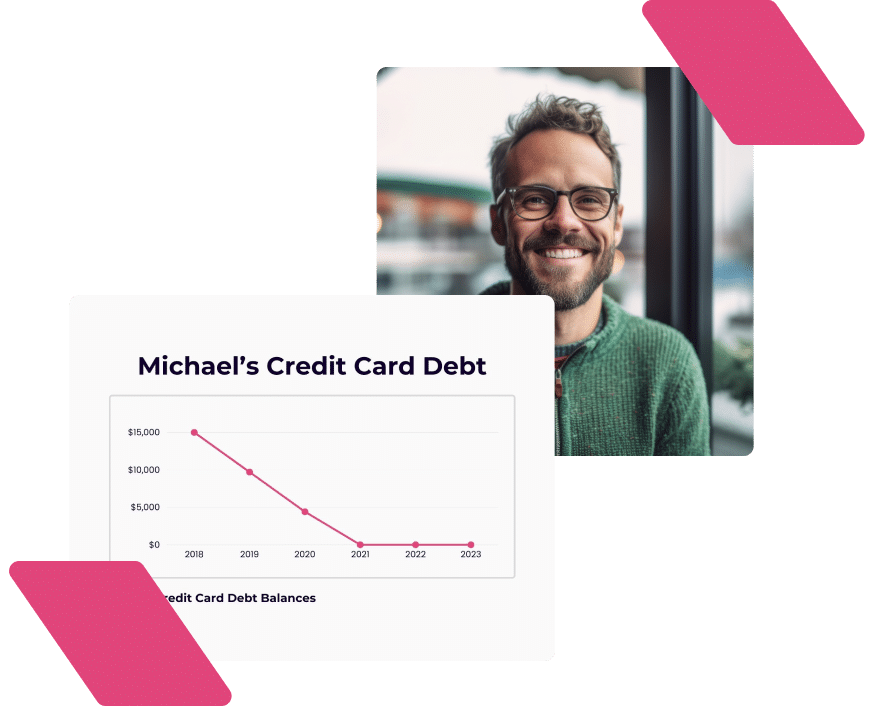

Michael's Momentum: Breaking the Chains of Minimum Payments

Before: Michael, a single father of two, was making only the minimum payments on his three credit cards, believing he was managing his debt. However, the accruing interest meant he was barely making a dent in the principal amount, totaling $15,000.

The Turning Point: After attending a Money Fit workshop, Michael realized the pitfalls of minimum payments. He decided to consolidate his debts and worked with our counselors to develop a tailor-made repayment plan.

Outcome: In 34 months, Michael was free of credit card debt. The money he previously used for repayments is now being invested in his children’s education funds.

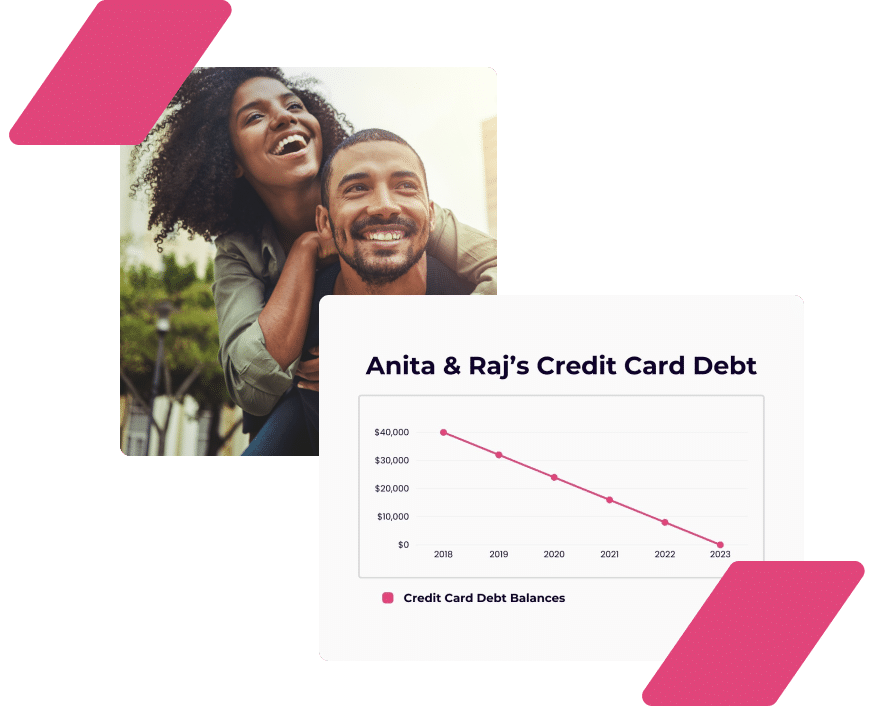

Anita and Raj: A Couple's Collective Effort to Ditch Debt

Before: Anita and Raj, newlyweds in their late twenties, started their married life with a combined credit card debt of $40,000. The stress began affecting their relationship, with constant arguments about money.

The Turning Point: The couple approached Money Fit for joint counseling. They learned about the benefits of a debt management plan, and how Money Fit would work with their creditors to reduce their monthly payments, lower their interest rates, and have them out of debt in 5 years or less.

Outcome: Today, Anita and Raj are not only debt-free but also have a healthy emergency fund and savings for their future home. Their journey with Money Fit not only improved their finances but also strengthened their bond as a couple.

The stories presented on this page are fictional and are intended for illustrative purposes only. While they are representative of real experiences and results, they are generalized to protect identities of actual Money Fit clients. If you find yourself relating to any of these tales, remember that it’s never too late to seek help and rewrite your financial story.

These success stories embody the transformative power of informed financial decisions and the pivotal role Money Fit plays in facilitating them. If you find yourself relating to any of these tales, remember that it’s never too late to seek help and rewrite your financial story.

FAQs: Answering Your Questions About Credit Card Debt

As credit card debt continues to impact millions worldwide, it's natural to have questions about its intricacies and solutions. We've compiled the most common questions we encounter at Money Fit, providing clarity and guidance for those navigating this financial challenge.

While the exact number can vary year by year, as of 2023, the average credit card debt for American households stood at $7,951. This figure underscores the pervasive nature of credit card debt and the need for effective management strategies.

Both are popular debt repayment strategies:

- Snowball Method: You start by paying off the smallest debt amount first, while making minimum payments on others. As each debt is cleared, you move to the next smallest, creating a “snowball” effect.

- Avalanche Method: You tackle the debt with the highest interest rate first, irrespective of its amount, aiming to reduce the overall interest paid over time.

The right method for you depends on your financial situation and psychological preference — whether you prefer quick wins (snowball) or long-term interest savings (avalanche).

Absolutely! Financial counselors or advisors, like those at Money Fit, can provide tailored advice, help you understand your debt landscape, and equip you with tools and strategies to effectively manage and reduce your debt.

Have more questions?

Resources to Help Manage Credit Card Debt

While our comprehensive guide offers a broad overview of credit card debt, there’s always more to learn. To further empower you in your journey towards financial literacy and freedom, we’ve curated a list of valuable resources, from detailed articles to tools that can help you gain deeper insights and make informed decisions.

Articles & Guides

- The Science Behind Credit Card Interest: Learn about the complexities of how interest is calculated and how it impacts your overall balance. Read More →

- The Emotional Toll of Debt: Understanding the psychological implications of long-standing credit card debt. Read More →

- A Comprehensive Guide to Debt Consolidation: Explore the pros and cons of merging multiple debts into one. Read More →

Tools & Calculators

- Debt Management Calculator: Calculate your estimated monthly payment through a Debt Management Program. Try it out →

- Credit Card Debt Calculator: Quickly estimate the required payments on your credit cards based on their balances. Try it out →

- 50/30/20 Budget Rule Calculator: This calculator offers a practical and efficient method to take when financial planning. Try it out →

Free Personal Finance Courses

- Credit Voyage & Savings Success: Created in partnership with the Capital One Impact Initiative, these courses are designed to help you change your behavior and achieve financial success.

- A Credit to You: Credit Basics: This course helps you understand what you need to know about credit histories, credit reports, and credit scores. Learn More & Sign Up →

Books & Literature

- “Everyday Money for Everyday People” by Todd Christensen: Unlock financial stability and success with ‘Everyday Money for Everyday People’ – your gateway to breaking free from the paycheck-to-paycheck cycle. Drawing from centuries-old wisdom and modern insights from numerous workshops, Todd Christensen offers actionable tips and inspiring stories to guide you in making savvy, everyday financial decisions. Transform your financial future with a book forged from real experiences and proven strategies.

- “Surviving Debt – 2023 Edition” by the National Consumer Law Center: Navigate your way out of debt with the 2023 edition of ‘Surviving Debt’, acclaimed as the ‘best all-around guide’ by Business Insider. For over a quarter-century, this comprehensive resource has empowered millions with hard-hitting, expert advice on tackling various forms of debt. From managing medical and credit card debt to understanding the intricacies of bankruptcy, this edition brings fresh insights on contemporary issues including student loan cancellation and dealing with debts incurred from an abusive partner. Equip yourself with strategies to avoid foreclosure, increase income, and safeguard your financial future, all curated by the nation’s leading consumer law experts.

Personalized Assistance:

Tailored Solutions for Your Unique Financial Situation

While general information and resources are invaluable, there’s no substitute for personalized guidance tailored to your individual circumstances. At MoneyFit.org, we understand the nuances and intricacies that each person’s financial situation brings. Here’s how you can engage with us for a more tailored experience:

One-on-One Credit Counseling

Every financial journey is unique. Whether you’re at the start of your credit card debt journey or looking for advanced strategies to manage existing debt, our expert counselors are here to guide you.

- What to Expect: A detailed analysis of your current financial situation, actionable strategies to manage and reduce your debt, and ongoing support to help you achieve your financial goals.

- Schedule a Session: Ready to take control of your financial future? Book your personalized counseling session now →

Custom Debt Management Plans (DMPs)

For those who require a structured approach to managing multiple debts, our DMPs provide a roadmap to financial freedom.

- What to Expect: Consolidation of multiple credit card payments into a single monthly payment, potential reductions in interest rates, and a clear timeline to becoming debt-free.

- Learn More: Interested in how a DMP can benefit you? Discover the advantages and get started →

Articles About Credit Cards

Equip yourself with essential knowledge about credit cards through our comprehensive articles:

- How Credit Cards Work

- Understand the mechanics and features of credit cards, from interest rates to grace periods.

- Reasons to Own a Credit Card

- Explore the benefits of having a credit card, from building credit to earning rewards.

- Reasons to Avoid Owning a Credit Card

- Discover potential pitfalls and reasons why some choose to live without credit cards.

- How to Get Out of Credit Card Debt

- Learn actionable strategies to reduce and eliminate your credit card debt effectively.

- Credit Card Mistakes to Avoid

- Familiarize yourself with common errors cardholders make and how to steer clear of them.

- Credit Card Debt Consolidation

- Explore the process of consolidating multiple credit card debts into one manageable payment.

Empower yourself with these insights and make informed financial decisions.

Money Fit Community Support

Connect with others on the same journey in our dedicated community forums. Share your experiences, learn from others, and find motivation in a supportive environment.

- Join the Conversation: From success stories to discussions on the latest debt management strategies, there’s a topic for everyone. Engage with the Money Fit community on X → or on Facebook and participate in the conversations.

Ready to Pay Off Your Credit Cards?

Don’t let credit card debt weigh you down. It’s time to take control and chart a path to financial freedom. Our team is here to guide and support you every step of the way. Call us at 1-800-432-0310 or apply online to start your journey towards a debt-free life.