Building Credit with the Fingerhut Advantage™ Credit Account Gets It Backward

In the middle of a cross-country move with my family, I have tried to take advantage of the hotel gym over the past few mornings, and I’ve noticed several ads by online retailer, Fingerhut™, promoting its credit card as a way to build credit. As an Accredited Financial Counselor®, I don’t oppose the concept of building and protecting your credit rating. From loan terms and car insurance premiums to apartment applications and employment hiring processes, your credit history and rating can have a huge effect on your life. So, the following question naturally came up after seeing these commercials:

Can Fingerhut™ help you build your credit score?

Using the Fingerhut Advantage™ credit card can help consumers build their credit rating, but it comes at a high cost due to the high-interest rate and a high risk of falling into overspending on Fingerhut™ and other consumer goods, especially since Fingerhut™ targets those with poor credit.

If you already exhibit the self-discipline to use credit cards only when you have the cash to repay the purchase in full with the next bill, then you likely already have good credit and have no need for expensive online retailers like Fingerhut™. Otherwise, you may qualify for a Fingerhut™ credit card, but you’ll need to approach your online shopping experience with caution and patience. Find below two major reasons why Fingerhut™ can be an expensive credit-building option, followed by a few alternatives for building your credit, ending with some ideas for anyone who has already secured a Fingerhut™ credit card and dug themselves into a lot of debt.

High-Interest Rate

Not surprisingly, the first cause of concern for Fingerhut™ credit cards involves their high-interest rates. Per Their web page on the cost of ownership purchasing products with its cards, Fingerhut™ offers two interest rates: one for those with better credit at 24.99% APR and another for those with poorer credit at 29.99% APR.

In other words, if you already have decent credit, make a $1,000 purchase on a 24.99% credit card, and carry that $1,000 balance for a year (making minimum payments while continuing to make small purchases), you will pay $249.90 in interest alone over the next twelve months.

If, on the other hand, you try to use Fingerhut™ to build credit for the first time or rebuild poor credit, those same purchases on a 29.99% credit card will cost you $299.90 over the next year. That’s 20% more expensive than the first option, which is already 54% more expensive than the average credit card interest rate of 16.22% APR.

You might think that the 29.99% credit card is just 13.77% more expensive than the average credit card APR of 16.22%, but that would be a mistake. There is a 13.77 point difference, but the first rate is 89% higher than the average rate.

89%! That’s the cost of having poor credit versus average credit. If you get angry because you think it’s unfair that people with bad credit pay more than people with good credit, then use that anger to focus on building good credit rather than using products for people with bad credit to purchase more overpriced consumer goods. See the alternatives section listed below.

But first, wait, because it gets better… or, er, worse. Not only is the 29.99% APR 89% higher than the average APR, but it’s also variable. That means that the card’s rate can go up or down with the market’s Prime Rate.

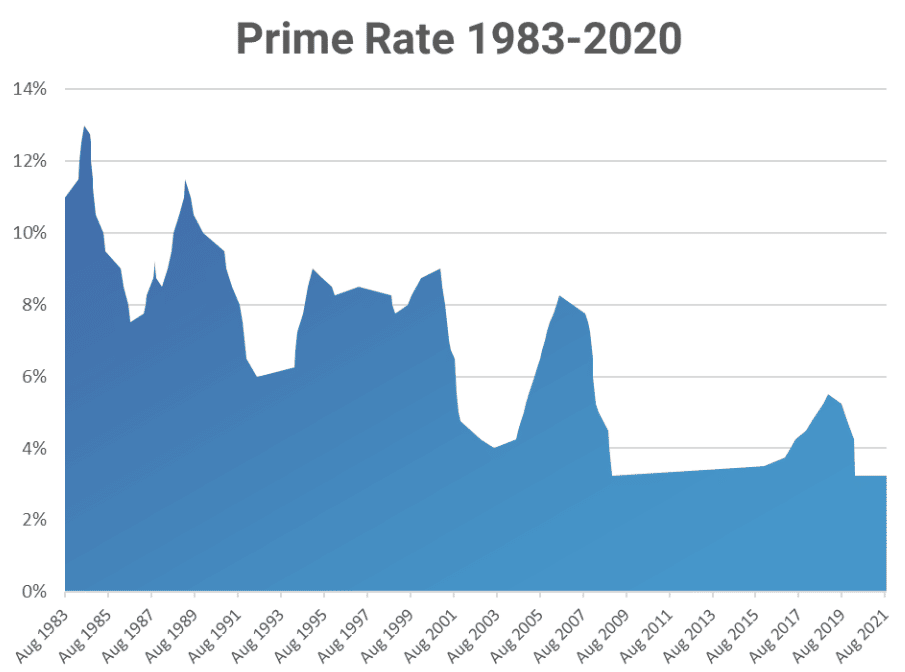

Here’s the kicker. From our graphic here, you can see that when the economy hits a recession, the Prime Rate tends to dive. As the economy recovers, the Prime Rate jumps.

So, here we are in the fall of 2021, still mired in the economic troubles of the COVID-19 pandemic. The Prime Rate has been at historic lows for more than a year at 3.25%. Which direction does that leave for the Prime Rate to go? Nowhere but up!

When the Prime Rate reaches 6.25%, the APR on the Fingerhut™ credit card for those with challenged credit will go up three percentage points as well to 32.99%. If the Prime Rate rises to 8.25%, this Fingerhut™ card will be charging its customers a 34.99% APR.

Variable interest rate cards may not seem like a bad idea, but when the variable interest will only go up, you need to think more than twice about your options.

Consumer Spending

The second and perhaps even riskier reason for avoiding a high-interest rate credit card has nothing to do with the interest rate at all. Instead, it’s all about the danger of running up the balance on the card. After all, like most credit cards, Fingerhut™ does not charge you any interest at all, regardless of the APR, so long as you pay off the balance in full each month. However, and again like most credit cards, if you carry even 1¢ from one month to the next, all future purchases will incur an interest charge until you pay down your balance to $0 again.

Fingerhut™ is a legitimate for-profit business. No one should begrudge Fingerhut™ for trying to make a profit. That’s how business works. They sell products. They pay employees. Those employees buy products and services from other companies, who pay their employees in turn. That being said a credit cardholder risks personal financial troubles if they allow themselves to overspend on consumer goods and services, whether from the Fingerhut™ online catalog or from the local convenience store.

I know what I’m talking about. I maxed out my first credit card to the tune of $2,000 in less than 36 hours at age 21. After that, I could barely afford to make minimum payments and spend virtually my entire 20s in credit card debt. I was even a Fingerhut™ customer at one point in college, though this was years before the Internet when they were still a mail catalog retailer. I highly recommend you take a different route.

Don’t use your Fingerhut™ credit card to purchase consumer goods you wouldn’t already purchase using cash or another method. Here’s what I mean. I clearly remember asking this question to a classroom of high school seniors in Meridian, Idaho about 15 years ago: “What are the benefits of using a credit card?” One well-meaning young man in the front row innocently said, “They help you buy things you can’t afford.”

If you can’t afford to buy them in cash, you can even less afford to buy them on credit, since credit adds fees and charges. That may not be what he meant, but it still expresses the attitude too many consumers have toward credit cards in general. They will even ask, “what’s the point of having a credit card if I can’t use it to buy stuff?” Credit cards are not about buying stuff you can’t buy with cash. They offer convenience and security, not a consequence-free opportunity to buy things you can’t afford.

Now, as to using the Fingerhut™ credit card on their website, you should hopefully already understand that Fingerhut targets high-risk consumers who can’t qualify for credit at traditional stores or with their own bank or credit union. Because of the increased risk that Fingerhut™ takes, they understandably charge higher prices as part of the reward for that risk. This, too, is not to be begrudged. The higher the risk you are willing to take, the higher the reward you should expect.

How much more expensive are products on Fingerhut™? Approximately 10% to 50% more expensive. Here’s a sampling as of today:

-

A 60” UHD TV from LG costs $749.99 on sale at Fingerhut™ (normally $929.99). That exact same TV from LG costs $499 at Target.com, not on sale. Their sale price is 33% more than Target’s regular price. Their normal price is nearly double.

-

The Body Flex Body Champ Magnetic Recumbent exercise bike costs $419.99 at Fingerhut™. At Dick’s Sporting Goods (not necessarily known for their low prices), the same exercise bike costs $299.99 on sale (regularly $379.99). Their price is 10% more expensive than Dick’s normal price and 40% higher than Dick’s on-sale price.

That said, the real challenge is not the final cost of the product. Fingerhut™, like virtually every automobile dealership in this country, doesn’t focus on the final cost of the product.

They focus on the monthly payment.

In fact, at the moment, if you shop around their site, the final price is in a smaller, unbolded font than their bolded monthly price. Clearly, Fingerhut™ targets the consumer who cares more about the immediate effects rather than the long-term consequences of their choices.

If the consumer would only stop to consider the opportunity cost, they might change their mind. In the case of the ultra-high-definition TV, if they made those same payments to themselves (to a savings account, for example), they could end up buying two of the same TVs in just over a year compared to just one with the monthly payments to the online retailer.

Alternatives

What alternatives might you consider to build your credit instead of Fingerhut™ and other expensive online retailers like Stoneberry and the Home Shopping Network? We recommend the following:

-

If you have utility accounts in your own name and make your payments on time, sign up for Experian’s free BOOST product to get “credit” for making those payments. It costs you nothing and can instantly improve your Experian credit score. Unfortunately, neither of the other two consumer reporting agencies (Equifax and TransUnion) have a similar product at this time.

-

If you need tires or brake work for your vehicle, consider financing your purchase at your local tire and brake store. Many offer in-house financing with lower qualification requirements than major retailers. Plus, since you’re buying from a tire and brake store, you won’t be as tempted to overspend in the future.

-

Check with your current bank or credit union to see if they offer a secured credit card. You will typically need to deposit $300 to $800 in a secured savings account, but you can then use a credit card with an equivalent credit limit. I recommend making just a single, small, set purchase each month (e.g. streaming music or video or your cell phone bill). Then, pay it off in full. The credit score models give you no better credit for making multiple purchases each month or making large purchases than they do for making a single, small purchase.

Already Have Fingerhut™?

But what if you already have a Fingerhut™ credit card and have a balance on it? First, since it comes with a high-interest rate, probably higher than another credit card or another account you have, focus as much of your disposable income as you can on paying down the debt.

Don’t make any more purchases on the card until you’ve paid it off in full. Only then should you consider making another purchase. Keep that to a single, small purchase that you can pay off immediately.

If you struggle to afford even the minimum payment on your Fingerhut™ card, reach out to them to see if they will lower your interest rate or monthly payment to something that works better. Otherwise, contact a nonprofit like Money Fit that will work directly with your creditor to work out more affordable repayment terms.