Immune to Bankruptcy? Think Again!

These Historical Icons and Celebrities Prove Bankruptcy Can Happen to Anyone

Nobody wants to admit when they are low on cash and high on debt. Nonetheless, many are left with no other choice.

If you dread the idea of filling out a few B-309 forms, perhaps some perspective can help soften the blow. History is laden with famous bankruptcy filers. While they all have celeb status or history on their side with their own unique stories, they have one thing in common: They all rode the tailwinds of their financial success only to find misfortune at some point in their careers.

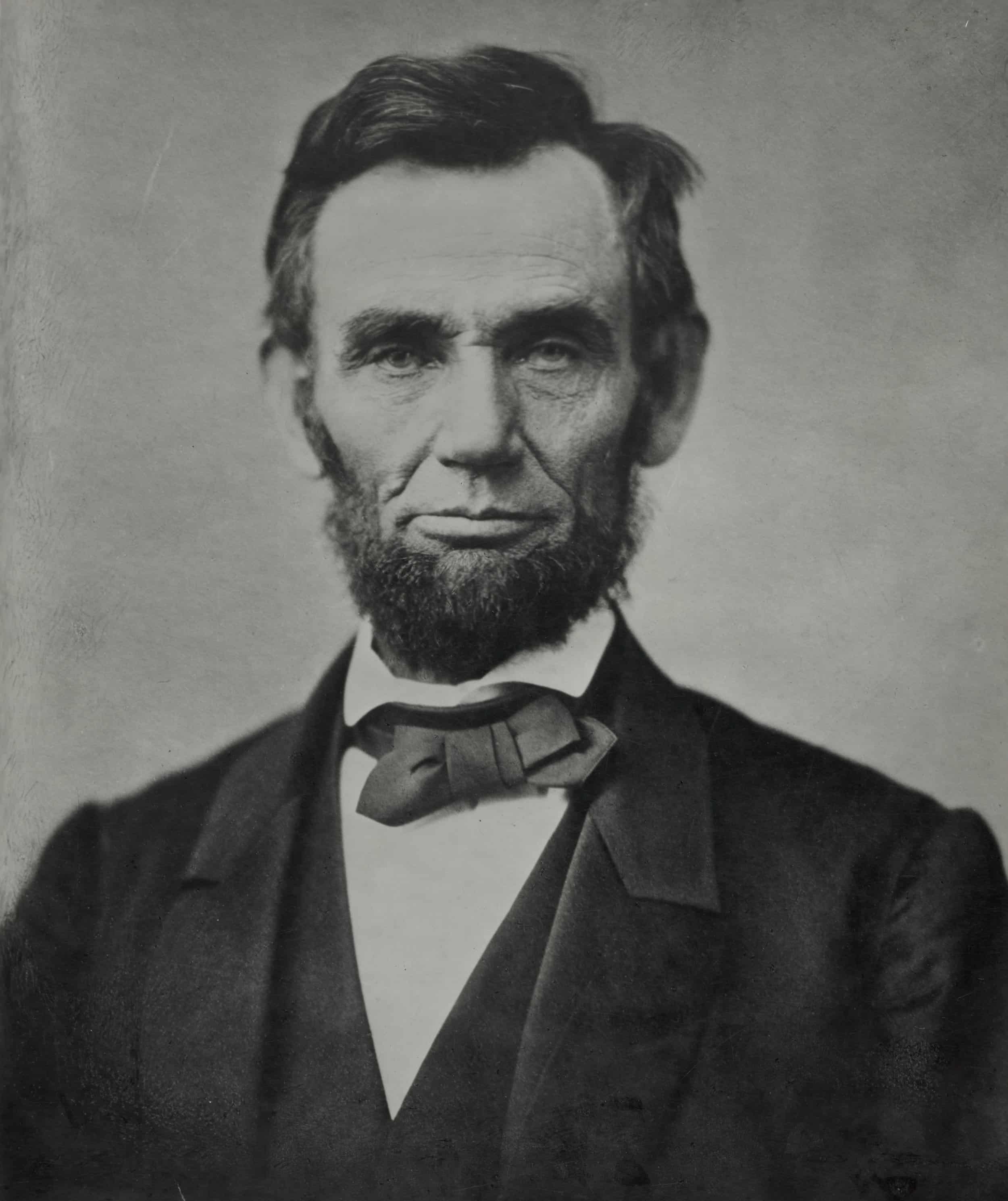

1. Abraham Lincoln

Believe it or not, the president who led the country through the Civil War also had to declare bankruptcy at one point in his life.

Before he took office in 1861, Abraham Lincoln was a business owner and investor. In the book, The President and the Freedom Fighter by Brian Kilmeade, we learn that Lincoln was in his early 20s when he ran a small general store in Illinois. He owned and managed the store sometime around 1833.

Noticing that the business was on a downward spiral financially, he opted to sell 50% of it. A willing investor bought half the business only to pass away, leaving future president Lincoln 100% of the liabilities.

In the late 1800s, bankruptcy laws were not as developed and “friendly” as they are today. Back then, filing for bankruptcy offered no safety net, especially after creditors brought borrowers to court.

Devoid of a single penny from his business, Abraham Lincoln had his home seized along with other assets he had. While he did manage to pay his creditors back, Lincoln’s experience with bankruptcy is a stark reminder that bankruptcy can happen to anyone.

2. MC Hammer

“Can’t touch this!” … is probably what MC Hammer told himself when he looked at the remaining $13 million of his fortune before he filed for bankruptcy in 1996. At the height of his music career, MC Hammer was reported to have amassed more than $30 million, according to The Telegraph.

This might sound like a lot. However, as another famous musical adage goes:

“Easy come, easy go.”

In the few years that he made his fortune selling millions of albums, he made as much as $70 million a year. With his albums selling like hotcakes, millions of dollars were to his name — at least until the early 90s.

During the early 90s, MC Hammer went on a lavish three-year spending spree that put him in debt. While his music continued to sell and remain popular, album sales alone were not enough to sustain his lifestyle.

By 1996, he was in debt by $13 million. His predicament forced him to sell everything he owned including the home which he spent millions of dollars renovating.

Nowadays, he has grown wiser in his finances, being a minister and consultant for startups. Today, he is proof that nobody is “2 Legit 2 Quit” being on a spending binge.

3. Walt Disney

Everyone knows Walt Disney as one of the pioneers of animated movies. What most don’t discuss are the struggles the creator of Mickey Mouse had to go through on the path to fame and success.

In the years leading up to 1922, Walt Disney was an animator in Kansas. He ran a small animation studio alongside two other animators. The studio was called Laugh-O-Gram. Based on an article from Forbes, Laugh-O-Gram was poised for success, turning the eyes of many large companies who needed animated ads.

Unfortunately, Laugh-O-Gram went out of business. Walt Disney was not turning in enough revenue for his animation studio. Part of the reason for this was that he was cheated by one of his distributors.

Left with nothing to pay his bills or creditors, Walt Disney had to declare bankruptcy by 1923. It was the swan song to an animation career that showed promise. Little did he know that bankruptcy would only be a speed bump on his road to fame and fortune.

Using money he borrowed from his family and friends, he produced Snow White — the first full-length animated film in history. Needless to say, the rest is history, paved by his other works like Mary Poppins and Cinderella.

Walt Disney’s experience proves that it takes more than wishing upon a star to get out of bankruptcy. It takes careful management of financial assets and knowing where to get financing.

4. Nicolas Cage

An acting career in Hollywood that spans decades might trick you into thinking Nicolas Cage lives the lifestyle of Castor Troy. On the contrary, the Con Air and Face Off star has had to dip into empty pockets thanks to a mega lawsuit in 2009.

Nicolas Cage was one of the highest-grossing actors during the 90s and early 2000s. His films like Face Off, Ghost Rider, and Con Air grossed millions of dollars at the Box Office, allowing him to amass as much as $130 million.

The amount of money he made would make the circumstances around losing it even more confusing than “the face switch”. According to Lad Bible, Nicolas Cage was notorious for his odd spending habits, indulging his fascination for expensive cars and dinosaur bones. He even did what many fantasize about doing with a large sum — buying an island.

His spending spree continued until it caught the eyes of the IRS in 2008. By 2009, Nicolas became caged in tax debt amounting to about $6 million.

5. Mike Tyson

Mike Tyson’s boxing career was lucrative enough to earn him millions of dollars in one night. The money came from multiple sources, including pay-per-view revenue and ticket sales. He even made millions selling merchandise and a handful of television appearances.

The fame and fortune did exactly what it does to many who taste it — it encouraged spending. Mike Tyson spent fortunes on mansions, limousines, designer clothes, and even exotic animals. It wasn’t long until alimony and divorce payments, his creditors, and the IRS came knocking.

Despite amassing roughly $400 million, nearly all of his money was encumbered in debts and payments to his ex-wife, according to the New York Times. This along with millions of dollars of debt with the IRS makes Mike Tyson one of the most famous bankruptcy filers on the list. The hard-hitting heavyweight boxing champion had to file for bankruptcy in 2003.

6. Gary Busey

Time Magazine mentions Gary Busey as one of the most iconic American actors in history. Gary Busey had everything a director would want in an actor stateside. Busey had looks, skills, and versatility. Soon after a few high-grossing films, Gary Busey would pick up one more characteristic ubiquitous among Hollywood elites — poor money handling skills.

In February 2012, Gary Busey shocked the headlines when he had to declare chapter 7 bankruptcy. Chapter 7 bankruptcy is when a person’s assets are not enough to pay for liabilities.

According to Time Magazine, Busey had only $50,000 to his name, with existing debts to various institutions amounting to a million dollars. How he amassed that much debt is surrounded by a lot of speculation.

What is certain is that he owed more than what he could pay to the UCLA Medical Facility, Wells Fargo, and the IRS. In short, by owing more than what he could pay, his fortune went up in “Gunsmoke.”

7. Meatloaf

Meatloaf’s bankruptcy filing made headlines in 1983. His bankruptcy was the result of more than mismanaged finances. Going broke was also the aftermath of a lawsuit involving his songwriter, Jim Stenman. The songwriter sued Meatloaf for a sum of $80 million, claiming that Meatloaf breached music rights laws.

The bankruptcy coupled with other issues caught up with Meatloaf. Between 1982 and 1984, the musician lost his voice, hindering him from making music. Shortly after, he was diagnosed with cocaine addiction and major depression.

Bankruptcy and empty pockets caused the singer to want to do everything for more than love. Due to debt, Meatloaf turned to small-scale gigs to pay bills — probably what he referred to when said “I won’t do that.”

8. Donald Trump

Donald Trump is a tycoon, was the 45th president of the United States, and became famous for two words in “The Apprentice.”

Donald Trump is probably the last person you would expect to find on this list of famous bankruptcy filers. However, as the trend of this list suggests, anyone can go bankrupt.

The only thing that sets former president Trump apart from his contemporaries on this list is the kind of bankruptcy he filed. Many of the people making up the list filed for personal bankruptcy. Donald Trump, at the time of writing, has never had to resort to that. Rather, he had to declare bankruptcy for his past businesses.

According to France Law Group, former president, Donald Trump, has filed for bankruptcy six times. The first was in 1991 with the Trump Taj Mahal. For more than a decade since that time, Donald Trump would have to file more bankruptcies. He also turned to bankruptcy protection for his failed entertainment and casino establishments.

This might make Trump seem like a business failure. However, the fact that none of the bankruptcies were personal teaches everyone the value of separating business assets from personal ones.

9. Burt Reynolds

The late great Burt Reynolds was no stranger to liabilities and B-309 forms. Burt Reynolds experienced the height of his success in the 70s and 80s as one of the most sought-after actors in Hollywood. However, like many celebrities, he lost his fortune faster than it took him to make it.

Burt Reynolds splashed his cash on everything from his estate, Valhalla, to luxuries like sports cars and horses. He also splurged on “great women”, even at the expense of his marriage and happiness at times. Living lavishly, to him, seemed synonymous with being a top box office draw.

In 1993, his divorce with Loni Andersson was finalized, requiring him to pay a hefty divorce settlement. Three years thereafter, Burt Reynolds continued with his high-profile lifestyle, incurring debt amounting to $10 million.

In 1996, he filed for bankruptcy. In one interview, he disclosed his eyes-wide-shut approach to his personal finances saying that he just “was never smart about money.”

10. Dave Ramsey

Everyone marvels at the financial expertise shown by Dave Ramsey on his radio shows. As one of the country’s trusted authorities on personal finance, Dave Ramsey knows a lot about avoiding bankruptcy. The reason for this is simple— he went through it.

In his early real estate career, Dave Ramsey applied for several loans, ballooning his liabilities before bringing in any assets. While he made millions of dollars at the age of 26 with these loans, banks were quick to collect. In 1988, he had to pay back his creditors and declare bankruptcy.

At the time of writing, his net worth has recovered to more than $200 million, according to Investopedia. He is now the CEO and founder of Ramsey Solutions, a platform he uses to help others out of bankruptcy and debt.

Wrapping Up

Bankruptcy happens to everyone — even to the best of us. However, if there is one lesson that can be drawn from this list, it is the importance of wealth management.

Nearly all of the famous bankruptcy filers on the list were reckless with their finances. Being smarter about their money allowed them to return to their old lifestyles albeit more modestly.

Another lesson is that there is life after bankruptcy. While it should not be plan A, it doesn’t mean you can’t recover.