Recent Articles in Bankruptcy

If you dread the idea of filling out a few B-309 forms, perhaps some perspective can help soften the blow. History is laden with famous bankruptcy filers. While they all...

Are you struggling financially and considering filing bankruptcy? Here is a quick guide on ways you can file Chapter 7 or Chapter 13 bankruptcy with little or no money.

People declare bankruptcy to be relieved from their debts; to restart with a clean slate. However, there is often an underlying and more nagging reason why people choose to take...

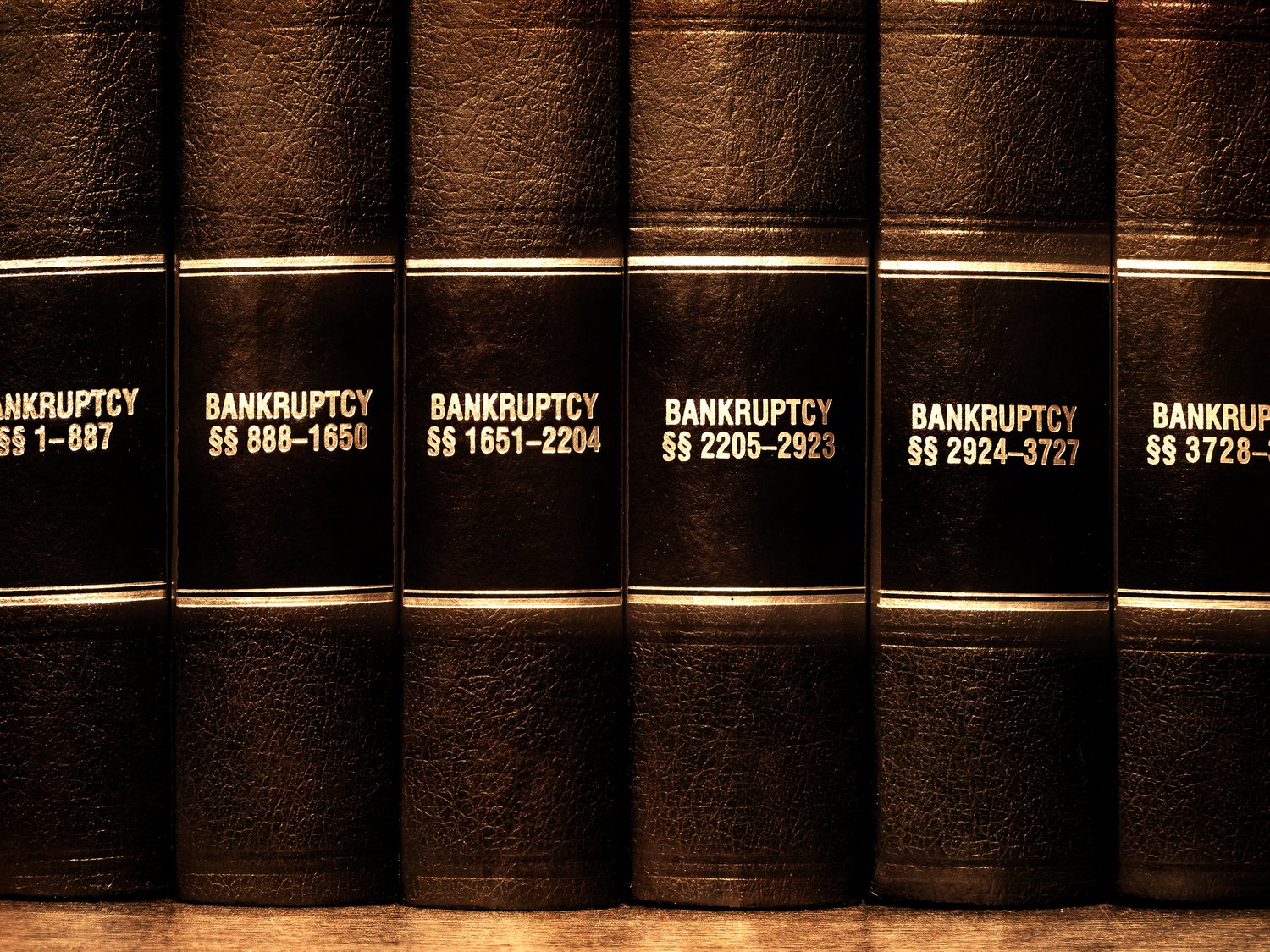

The first part of our four-part series titled Bankruptcy in America examines why people file for bankruptcy. We review some of the most famous bankruptcy filers and emphasize that bankruptcy...

From its terminology to its portrayal in popular culture, bankruptcy presents a confusing picture of how its processes work and how filers go about actually getting protection for their assets....

Money Fit by DRS Inc. is publishing a four-part series to explain the bankruptcy process in great detail. Our intention is to create a guide for individuals looking to understand...

Bankruptcy is like a divorce from your debt. You will feel freedom and relief after letting go of the weight of an unmanageable debt load, but it hits like a...

Bankruptcy is not the end of the line and does not spell eternal financial doom for filers. Both our research and our experience with former bankruptcy filers show that recovery...

Each chapter of bankruptcy has a specific reason for existing, along with a set structure to address an individual or business’s debt and how to proceed moving forward. It’s important...

The unexpected, devastating, and far-reaching economic effects of COVID will remain with our country and the world for years. Individuals may even feel the consequences for the rest of their...