Recent Articles in Debt

Is Credit Counseling Effective for Managing Debt? Explore how nonprofit credit counseling can help you tackle debt with proven strategies, backed by real results and expert insights from over two...

Understanding Debt: What It Means for You Millions of Americans carry some form of debt—from credit card balances to mortgages and student loans. But what exactly does it mean to...

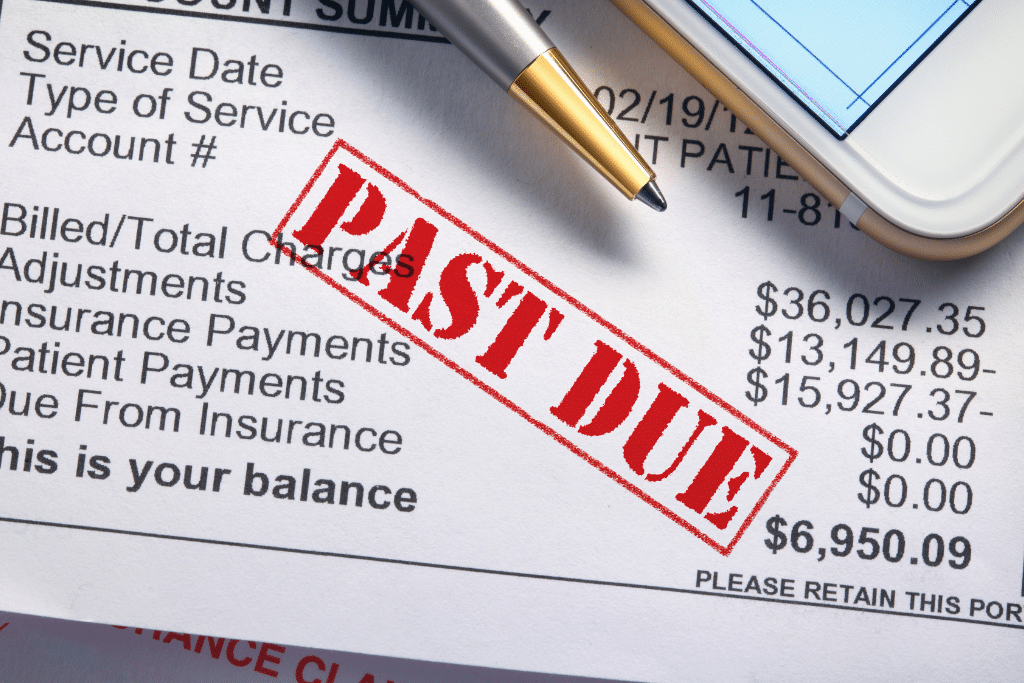

Most Americans will be contacted by a collection agency at some time in their adult lives, thanks in no small part to the disheveled and confusing medical billing systems around...

How to Dispute a Debt in Collections Step-by-Step A collections notice lands in your mailbox—maybe the amount looks wrong, or the debt doesn’t ring a bell. It’s unsettling, but you’re...

If you are concerned your family member or friend who has too much debt is abusing credit cards or is otherwise heading toward a financial abyss, your intervention might be...

What Happens to Medical Debt When Someone Passes Away? Medical debt is a common issue in the U.S., affecting millions each year. Even with health insurance, out-of-pocket expenses can add...

How Co-Signers, Estates, and Insurance Affect Auto Loans When Borrowers Pass Away Coping with the loss of a loved one is an emotionally challenging experience, and the added responsibility of...

We've all heard the stories of celebrities who have blown their fortunes and gone bankrupt. It’s true — even celebrities find themselves buried under a mountain of debt. Here are...

The debt Snowball repayment method works best for individuals and households who believe that seeing progress in their debt repayment plan as early as possible will keep them the most...

The debt avalanche repayment method works best for any individual or household looking for a way to pay as little interest as possible during the repayment period. The individual or...