Having Hope Can Help You Reach Your Goals

Hope cannot be manufactured. Hope must come from within. When hope is missing in life, the future appears dark and menacing. In my classes, I often meet people who feel financially hopeless, having lost job after job, using up any emergency savings they had, and feeling as though no matter what they do, it will never be enough to overcome their challenges.

Then there are others who sit right next to the hopeless, who have gone and are going through very similar challenges, and yet remain hopeful for a positive future. How is it that they remain so? Does hope matter? Do the hopeful end up more financially successful than the hopeless?

By financial success, I’m not talking about earning a certain income or saving a certain amount, or living a certain lifestyle. I’m referring to achieving one’s financial goals. Without hope, we may feel that all is lost and that no matter what we do, our financial lives and financial futures are predestined toward failure. Consequently, we stop looking for opportunities to progress and stop taking advantage of situations that would lead us to an improved future.

With hope, on the other hand, we believe that our future will be better than our present. We stay alert and make ourselves aware of what is going on around us that can benefit us.

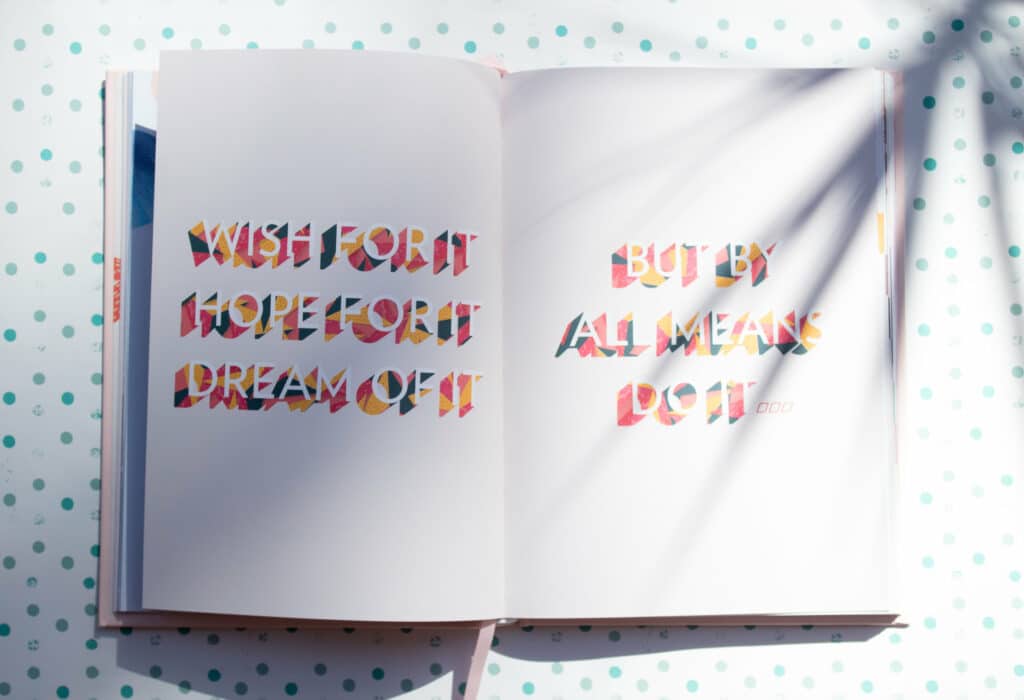

The hopeless think that hope is a feeling.

The hopeful knows that hope is an action.

So, what action or actions should the financially hopeless take in order to become financially hopeful?

Let me answer by sharing the experience I continue to have regularly in my classes. When I walk into a class, I can tell within a matter of minutes who is or eventually will be financially successful. It’s not discerned by the clothing they wear, the watches or jewelry they’re sporting, their accent, or the color of their skin. Those who are or will eventually be financially successful are those who are actively involved in the presentation. Whether the class I’m teaching is their first experience in financial education or they already have an MBA, those who are or will be financially successful are those who are open to continued learning. The main group of class attendees I truly worry about are those individuals sitting in the back, arms folded, glaring at me with an expression that seems to say, “I dare you to teach me something because I’m not interested,” or “There’s nothing you’re saying that is of interest to me because I already know all of this.”

I’ve been studying, researching, and teaching these topics for almost a decade now and still learn something new virtually every week. Since I’m not a remarkable person, I’m sure that if I can learn something new, others can too.

What can you do to build hope?

I’m not guaranteeing that your dreams will come true, but your main task is to envision the kind of financial future you desire and simply write it down.

Goal setting is important because it works. Here’s what I do in many of my classes: I ask what types of financial goals most of us have either set for ourselves or have at least heard about. The top two answers I get, in a virtual dead heat, are (1) to retire well and (2) to buy a home. Why are these essentially the only financial goals we come up with? Because there’s money to be had in helping people reach these goals, and if that’s the case, there are businesses set up to help, and these businesses tend to advertise.

We hear of them because a business is selling them to us. That’s not a bad thing. These goals are worthy and important. But for most of the financially hopeless, both of these goals are too long-term in scope and too large in breadth. Here’s the problem, mathematically speaking:

Financial Goal Motivation = 1/($ x time period)

This means the more money we have invested into our goal and the longer the time period we have to reach it, the less motivation the goal provides us.

Why? Because we are creatures of the present. We don’t live in the future. Our reality is today and possibly a few days or weeks down the road. Setting a goal, for example, to have $1,000,000 in retirement investments thirty years from now is something to which we just can’t relate in our daily decision-making. Seriously! What does $1,000,000 have to do with whether I’m going out for a fifteen-dollar dinner tonight? Actually, a lot when we think about it. Since most of us would be hard-pressed to figure out off the top of our head, how many fifteen-dollar dinners we could enjoy with $1,000,000 (66,667 in case you’re wondering), and second, we have no concept of how many dinners that really is (is that a lifetime’s worth, two lifetimes, or more? Actually, it’s 182 years worth), there is no emotional connection between the fifteen-dollar expense and the $1,000,000 goal. Without that emotional connection, there is no braking system to keep spending from speeding out of control and over a financial cliff.

I believe the most motivating goals we can set for ourselves are the small short-term ones. For example, the things we want to buy, activities we want to do, achievements we want to reach, and savings that we want to build over the next several months and require less than $1,000.

Once we have these small, short-term goals written down, we have established a vision of our future and a path for getting there. If we can set up these expectations for what we want in the future, we’ve just given ourselves some financial hope.

How Goal Setting Really Works

It’s not that writing a goal will somehow magically give us more income to achieve that goal. Rather, by writing down our goals, we’re more likely to notice opportunities to achieve them. Here’s the example I use in my classes.

Let’s say my wife Wendy, and I, sometime in the next six months, want to go on a three-day romantic getaway to a ski resort. Once we write that wish down, it becomes a goal.

Since we’ve written it down and posted it somewhere that’s visible to us each day, we’ll be on the lookout for opportunities to go. Here’s how the magic works:

Imagine a conversation with a friend who says they’ve just returned from this ski resort and it was a perfect weekend. If Wendy hadn’t written it down, the conversation would have likely ended with the words, “That’s great! I’m glad you had a good time.” That’s it.

Since we wrote down the goal, when I hear my friend mention the ski resort and how fantastic it was, I’m all over it!

“Where did you stay? What did you do? Any recommendations? It might come out that my friend stayed at his sister’s condo, and perhaps she’d be more than happy to cut us a fantastic deal on our three-day getaway.

Writing down goals doesn’t make them magically happen. It does, however, make us absolutely more aware of opportunities that come our way that helps us achieve our goals.

Financial Hope and Opportunity Step-by-Step

You may have heard of SMART goals. While there is a traditional version of SMART goals taught the world over, I’ll use the following modified version: Specific, Meaningful, Attainable, Rewarding, and Timely. Let’s follow these steps to create powerful, personal financial goals:

Specific: Write down what you want to do, buy, or achieve. Include details that answer questions such as, “Who is involved?” and “Where is this activity or product?”

Meaningful: Whatever you choose to write down as a goal needs to be important to you. It can be a vacation to the beach, a picnic in the mountains, or a set of new tires for your Hyundai. As long as it’s important to you, it will be motivational, and you’ll be more likely to stick with it.

Attainable: Keep the amount of money required for this goal fairly modest, usually requiring $1,000 or less. If the amount gets to be more than that, you’re less likely to see it as a realistic goal.

Rewarding: Imagine yourself achieving the goal. Write down a few words or phrases that you believe will describe how you’ll feel. You might write down something like, “I’ll be walking on Cloud Nine, having fulfilled a lifelong dream.” Hopefully, that’s not what follows the “Buy a new set of tires for the Hyundai goal!” Or you might write, “I’ll finally feel a weight lifted off of my shoulders when I remove this goal from my to-do list.” Give this step the time it merits. Really consider the reason you want to achieve it and spell it out.

Timely: Write down the month and year in which you want to achieve this goal. Writing “six months from now” doesn’t cut it. Every time you look at the goal in the future, it will still tell you that you have another six months. That’s not good enough. Write down the month and year you want to accomplish the goals, and make sure it’s not more than twelve months away. Beyond twelve months, for most of us, becomes a bit too nebulous. It becomes too easy to see that much time as “plenty of time.” Time in which to do what? To procrastinate, that’s what. When you make the time frame short-term, you’re more likely to go to work on it immediately.

Best of luck with your debt-free endeavors! If you have any questions or comments please share them below and I’ll respond as quickly as I can!