Expert Advice on How You Can Make the Most of Your 2020 Pandemic Stimulus Check

According to a survey from MoneyDoneRight.com of more than a thousand consumers, 43% of Americans plan to use their stimulus check to pay off debt, another 24% plan to save it, and only 33% play to spend or invest it. The IRS terms these checks “Economic Impact Payments,” reflecting one of the goals of the stimulus package to boost the economy during this unprecedented slowdown.

What should you do with your coronavirus economic stimulus check?

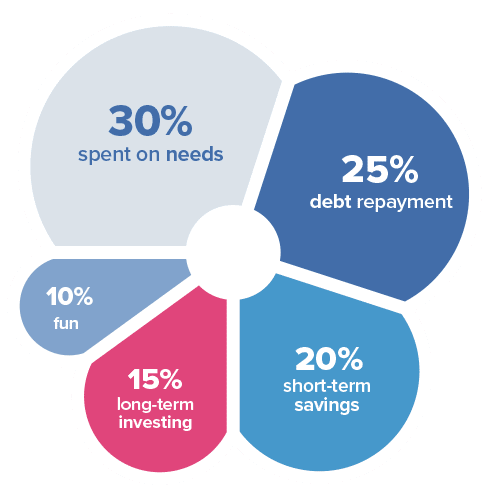

While every household has its own unique financial situation and needs, options for spending your economic stimulus payment include spending on needs, paying down debts, saving for emergencies and short-term goals, investing for the long-term, and spending on fun and splurges.

Deciding on Your Spending Priorities

You do not need to choose one of these options at the expense of the others. In fact, you may want to consider spending at least a portion of your stimulus check on each of these categories, weighting some more than others according to your household priorities.

Before your check arrives, review the following distribution percentages and adjust them for your needs and wants:

Spending on Needs – 30%

It is hard to justify investing in the long-term or saving for short-term goals when your washing machine is dead or your car is not reliable enough to get you to your place of employment. Using 30% of your stimulus check on making critical repairs will stabilize your household and minimize your need in the future to turn to credit cards or, worse, payday loans, to fix important appliances, replace unusable furniture, or get your transportation or cell phone working again.

Thirty percent of your stimulus check for spending on your needs breaks down like this:

-

Individual adult: $360

-

Single Parent of One Child: $510

-

Couple: $720

-

Couple with One Child: $870

-

Couple with Two Children $1,020

Even for a single adult, 30% of your stimulus check will be enough to pay for many repairs on a vehicle, fix or replace an appliance, or get a new cell phone.

Paying Down Debts – 25%

The MoneyDoneRight.com survey indicates that this will be the most popular use of our stimulus checks in 2020. As a nonprofit credit counseling agency, we always recommend the acceleration of debt elimination as part of every personal household spending plan. For this reason, many might find it surprising that we do not place debt reduction in the top priority spot. In advance of recessions and during both economic emergencies and natural disasters, saving money for near-term needs will always take precedence. In full-on, lock-down emergencies, we might even recommend making only minimum payments to your debt accounts while focusing all available cash on saving for present and future necessities.

With regards to your 2020 coronavirus stimulus check, though, you can still make a big difference in accelerating your debt reduction by sending off 25% of the check to your creditors. Which account should you send it to? Although you might be tempted to split it up evenly between your debts, we recommend you focus on just one account while making minimum payments to all other debts. For more details, you can see our in-depth analyses of the Do-It-Yourself Debt Relief options here. In brief, if you want to minimize the amount of interest you pay (the cost of your debt), send this 25% to your account charging you the highest interest rate, usually a retail card or store card (this is the Avalanche Method). If you want to rebuild your credit fastest, send the 25% to your newest account that has a balance on it (this is the Landslide Method). If you feel you need a quick moral victory to remain motivated to your debt reduction plan, send the 25% to your account with the smallest balance (this is the Snowball Method).

How much will twenty-five percent of your stimulus check be for paying down your debts? Here’s the breakdown:

-

Individual adult: $300

-

Single Parent of One Child: $425

-

Couple: $600

-

Couple with One Child: $725

-

Couple with Two Children $850

While $300 may not seem like much if you have thousands or tens of thousands of dollars of consumer debt, consider this. Your $300 additional payment on a $5,000 credit card account with a 15% annual interest rate could save you over $200 in interest payments in the future. That is a 67% return on that payment!

If your interest rate is 25%, that $300 could save you over $600 in interest payments, or a 200% return. That sort of savings should matter to virtually all households.

Saving for the Short-term – 20%

The bane of economists and many legislators who backed the stimulus package, savings can seem anti-stimulus. By saving money, you’re not spending it in the community and, consequently, not stimulating business, manufacturing, and the economy in general. This is 100% true if you place your saved money in a piggy bank or a safe at home.

However, if you keep your savings in a bank or credit union (and you should), a majority of your savings balance becomes available for the financial institution to lend to other bank customers or credit union members for large purchases like vehicles, homes, and business start-ups. In this way, at least a portion of your savings is helping to stimulate the broader economy.

Twenty percent of your stimulus check for saving for the short-term equates to the following:

-

Individual adult: $240

-

Single Parent of One Child: $340

-

Couple: $480

-

Couple with One Child: $580

-

Couple with Two Children $680

When you worry that $240 in a savings account typically earns less than $3 a year in returns, remind yourself that you are saving money not to generate returns but to pay for emergencies and short-term goals. Think of savings as essentially parking your money in a safe spot for a few months or a couple of years so that you don’t spend it elsewhere.

Investing for the Long-term – 15%

As opposed to saving money in banks and credit union savings accounts, you invest for the long-term with the expectation that your money will generate more in returns than you invested to begin with. This means it should earn enough to pay for fees and taxes you might have to pay on the returns.

With the volatility of the stock market over the past few years, you may worry that investing is not for you, that it’s too risky. In the early spring of 2020, stock markets around the world had their worst days and weeks in history. Stock prices fell dramatically. So what did the average investor want to do? Sell and get out of the stock market. But, what if you thought of this like you do your weekly shopping? When you’re at the store and you see the price tags indicate that you can now purchase the item for 25% less than you could yesterday, do you buy or ignore it? The ultimate guide to smart investing is the old but very true adage, “Buy low and sell high.” The time to buy low is when stock prices are plummeting, which means you must overcome the human tendency to feel fear when investing during a down stock market.

Additionally, by investing a portion of your stimulus check, you are giving money directly to businesses in the US and beyond to boost their productivity, grow, or at least minimize the effect of the current crisis and the coming recession.

Fifteen percent of your stimulus check for investing in the long-term breaks down like this:

-

Individual adult: $180

-

Single Parent of One Child: $255

-

Couple: $360

-

Couple with One Child: $435

-

Couple with Two Children $510

What can you invest in for $180? You can purchase individual shares of just about any publicly traded company, but you can also purchase shares in a mutual fund through your 401(k) or IRA. You could also purchase one or more shares of many Exchange Traded Funds that have low fees and track the general stock market trends. Talk to your financial advisor about making an additional purchase or using a “robo-adviser” (automatically-generated recommendations) from a broker such as TD Ameritrade, Fidelity Investments, Charles Schwab, or E*Trade.

Spending on Fun and Splurges – 10%

Although the smallest of the five recommended spending categories, this one might just take the honors for most important. Without throwing in a little fun, enjoyment, or pleasure, you might not even consider the other categories. The same holds true for spending plans (aka budgets) generally. If you don’t plan for some fun money, you will still have fun but rob from your other budget categories.

Ten percent of your stimulus check for spending fun and splurges breaks down like this:

-

Individual adult: $120

-

Single Parent of One Child: $170

-

Couple: $240

-

Couple with One Child: $290

-

Couple with Two Children $340

Even 10% can make for a fun night with your family. You could use your fun money to buy yourself something new, add a new piece of home décor, or even donate anonymously to someone in need. You might order out from your favorite restaurant or try a new one. Buy something you would never pay for with your hard-earned paycheck money.

Whatever your choice, find a way to release some of the tension of the quarantine. Otherwise, you might just find yourself holding in the steam until it explodes in a rush of spending called a splurge (online or at a brick and mortar).

How to Spend Your Stimulus Check Calculator

How to Spend Your Stimulus Check Video

Related Questions

Do you have to pay taxes on your stimulus check? No. As a tax credit, the 2020 CARES Act tax credit stimulus payment will not affect your taxable income and will not affect your 2020 tax return or tax refund. The tax credit will not affect or change the tax bracket you are in.

If you are on social security, how should you spend your stimulus check? Social security recipients will also receive a CARES Act stimulus check. Since few social security recipients need to worry about job loss, the stimulus check is a windfall that should be spent on critical needs or priority wants, with fewer concerns about long-term investments.