The Hidden Battle with Credit Card Debt

In an era where digital transactions and credit facilities are more accessible than ever, credit card debt has become a widespread financial concern. This mounting debt is not just a result of economic factors; it’s deeply rooted in the psychological behaviors and decisions of consumers. The convenience and immediacy of credit cards, combined with a complex array of emotional and social factors, have led many into a spiral of debt that can be challenging to escape.

Understanding the psychology behind credit card debt is crucial in addressing this issue. It’s not simply about spending beyond one’s means but about understanding the why and how of these spending habits. From the instant gratification of making purchases to the influence of social media and societal norms on our spending decisions, various psychological factors play a significant role in the accumulation of credit card debt.

As we dig deeper into this topic, we aim to uncover the psychological triggers that lead to excessive credit card use and the subsequent debt that follows. This exploration is not only about highlighting the problem but also about providing insights and strategies to help individuals break the cycle of debt and develop healthier financial habits.

Understanding the Psychology Behind Credit Card Debt

Instant Gratification and Credit Cards

One of the key psychological factors in credit card debt is the concept of instant gratification. Credit cards offer the unique ability to acquire goods or services immediately, without the immediate need to part with cash. This ease of access can lead to impulsive buying decisions, where the pleasure of acquisition outweighs the consideration of long-term financial repercussions. Understanding and mitigating this desire for immediate gratification is essential in managing and preventing credit card debt.

Social Influences on Spending

Social factors also play a significant role in credit card usage. The influence of peers, coupled with the portrayal of lifestyles on social media, can create an unconscious pressure to spend to keep up with perceived social standards. This phenomenon often leads to spending beyond one’s means, with credit cards facilitating this unsustainable lifestyle. Recognizing these social pressures and learning to differentiate between needs and wants is crucial in curbing unnecessary spending.

Emotional Spending: Beyond the Price Tag

Emotions significantly influence spending habits. Many individuals find themselves spending money as a response to emotional triggers like stress, happiness, or even boredom. Credit cards make it easier to give in to these emotional spending sprees, often leading to regrettable financial decisions. Being aware of emotional triggers and developing healthier coping mechanisms can help in controlling this aspect of credit card use.

Denial and Lack of Awareness

Another psychological aspect of credit card debt is the state of denial or lack of awareness about one’s financial situation. Many people either underestimate the severity of their debt or choose to ignore it, hoping it will resolve itself over time. This denial can lead to a worsening financial situation, as interest and fees accumulate. Educating oneself about the real impact of credit card debt and accepting the reality of one’s financial situation is the first step toward resolution.

The Cycle of Credit Card Debt

Credit card debt often starts small but can quickly grow into an overwhelming burden due to several reinforcing factors.

Escalation of Small Debts

Initially, small amounts of debt might seem manageable, but they can escalate rapidly. The convenience of credit cards can lead to a series of small purchases that, over time, accumulate into significant debt. This gradual increase in debt is often unnoticed until it becomes a substantial financial strain.

The Role of Interest Rates and Minimum Payments

Interest rates play a crucial role in the cycle of credit card debt. High interest rates can cause the owed amount to balloon, especially when only minimum payments are made. Minimum payments, while seeming manageable, primarily cover interest rather than reducing the principal amount. This scenario leads to a prolonged debt period and increased total interest paid.

Psychological Impact of Mounting Debt

The psychological impact of growing debt cannot be understated. It often leads to stress, anxiety, and a sense of hopelessness, especially as the debt seems to grow despite efforts to control it. This emotional toll can further exacerbate the situation, as individuals might resort to more credit card use to cope with these negative feelings, thus perpetuating the cycle.

Understanding the cycle of credit card debt is crucial in recognizing the seriousness of the situation and taking steps to break free from it. Acknowledging these patterns is the first step towards developing a strategy to escape the debt trap.

Strategies to Break the Cycle of Credit Card Debt

Breaking free from the cycle of credit card debt requires a combination of awareness, discipline, and practical strategies.

Awareness and Acknowledgment

The first step in breaking the cycle is acknowledging the problem. This means confronting the reality of the debt and understanding its impact on your financial and personal life. Accepting that there is an issue is crucial for motivating change and developing a plan to address it.

Budgeting and Financial Planning

Developing a solid budget and financial plan is essential. This involves:

- Tracking all income and expenses to understand where your money is going.

- Identifying areas where you can cut back on spending.

- Allocating funds to pay off debts as quickly as possible.

- Planning for future expenses to avoid falling back into debt.

A budget helps in regaining control over finances and provides a roadmap to debt freedom.

Understanding and Managing Triggers

It’s important to identify personal triggers that lead to excessive credit card use. Whether it’s emotional spending, social pressures, or the lure of sales and discounts, understanding these triggers can help in developing strategies to avoid or manage them. This might involve setting spending limits, finding alternative activities to cope with emotions, or consciously avoiding situations that lead to impulsive spending.

Seeking Professional Help

Sometimes, the best way to tackle credit card debt is to seek help from professionals. Credit counseling agencies and financial advisors can offer guidance and tools for managing debt. They can help in negotiating with creditors, setting up a debt management plan, and providing education on managing finances effectively.

Implementing these strategies can pave the way towards not only breaking free from credit card debt but also towards a more secure financial future.

Developing Healthy Financial Habits

Establishing and maintaining healthy financial habits is key to preventing the recurrence of credit card debt and securing long-term financial health.

Building a Savings Habit

Creating a savings habit is foundational to financial wellness. Start by setting aside a small, manageable amount of money from each paycheck. This fund serves as a buffer against unexpected expenses, reducing the reliance on credit cards. Over time, aim to grow this into an emergency fund covering several months’ worth of living expenses.

Wise Use of Credit Cards

Using credit cards wisely is crucial:

- Reserve credit card use for necessary purchases rather than impulse buys.

- Aim to pay off the entire balance each month to avoid interest charges.

- If you carry a balance, prioritize paying it down quickly.

- Be mindful of credit card limits and strive to use a small percentage of available credit.

Adopting these practices helps in building a good credit score and avoids the pitfalls of debt accumulation.

Long-Term Financial Planning and Goal Setting

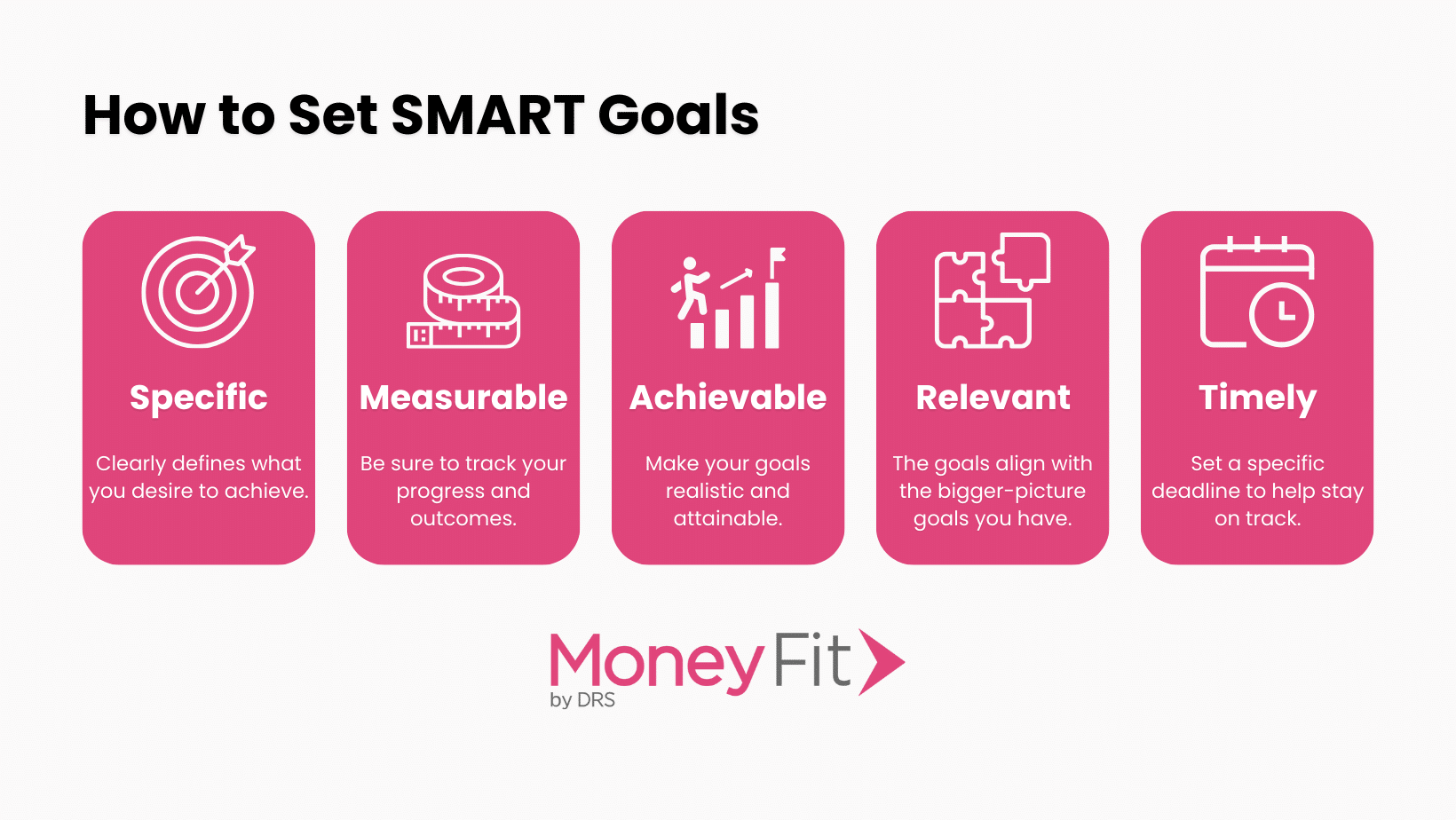

Long-term financial planning involves setting financial goals and creating a plan to achieve them. This might include saving for retirement, buying a home, or funding education. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART Financial Goals). Regularly review and adjust these goals as your financial situation evolves.

Setting and working towards these goals not only helps in keeping credit card use in check but also provides motivation and a sense of purpose in your financial journey.

Turning a New Leaf in Financial Wellness

The journey through understanding and overcoming credit card debt is both challenging and enlightening. It involves looking into the psychological underpinnings of our spending habits, recognizing the cycle of debt, and actively working towards breaking free from it. The strategies and habits discussed in this article are not just steps to escape debt but are also foundational practices for long-term financial health and stability.

Remember, overcoming credit card debt is more than just rectifying numbers in a bank account; it’s about transforming your relationship with money. It’s a path toward gaining financial literacy, developing self-awareness, and making informed decisions that align with your financial goals and values.

As you embark on this journey, stay patient and persistent. The road to financial freedom is often incremental and requires consistent effort and dedication. Each step you take towards this goal not only alleviates the burden of debt but also empowers you with the skills and confidence to manage your finances effectively for years to come.

Embrace Your Financial Future

We encourage you to continue exploring ways to improve your financial health. Visit www.moneyfit.org for more resources, guidance, and support in your journey towards financial wellness. Whether it’s through reading articles, attending workshops, or seeking personalized advice, taking proactive steps to understand and manage your finances is within your reach.

Remember, you’re not alone in this journey. There are tools, professionals, and communities ready to support you in turning a new leaf in your financial life. Take that first step today, and move towards a future where you are in control of your finances, not the other way around.