What to Do with Savings after Reaching the 3 Months Goal

I get to teach personal finance classes to groups from time to time. Savings is regularly a topic I address, and most groups confidently answer “at least 3 months” when I ask how many months’ worth of bills they should have in their emergency savings account. Financial educators and other professionals have beat their drums on this notion so loudly and for so long that it’s becoming a generally accepted principle. While we have our own view of appropriate savings goals, let’s address the question that comes up for conscientious savers:

What should I do with my money after I’ve saved 3 months’ worth of my living expenses?

Contributing to accounts that help prepare you for future financial needs will always be important to your financial stability. Whether you add additional funds to your emergency account, put money toward short-term goals, or invest for long-term needs, keep saving.

Let’s look at these three future-facing options. Together, they allow you to continue preparing for a stable financial future, so keep depositing money each month into their corresponding accounts.

Emergency Savings

Be sure that you have set your own emergency savings goal. Whether you listen to popular radio talk show personalities that tell you to save $500 or your financial advisor that says you need enough savings that will last you for six months in case you lose your employment, those are all pieces of advice meant for general audiences, not for you specifically.

To determine how much is enough for you to have in an emergency savings account, consider your given your profession, your monthly income, and your monthly living expenses. How long would need your emergency fund to last in case you found yourself without income, whether due to unemployment or a medical issue?

While still a general formula, the following equation comes much closer to helping you know how much you may need to survive a period of unemployment. Here are the specific steps:

- First, determine how much money your household would need to survive for a month without income. Add up only your survival and obligatory expenses, not your discretionary or optional spending. You will include housing (rent/mortgage and utilities), groceries, debt payments (minimum payments), cell phone, Internet, and some amount for clothing at thrift store prices.

Now would be a great time to look at your monthly subscriptions and other bills that you have obligated yourself to pay, such as gym memberships and streaming media. If you had to, could you cancel those services without a penalty? If not, consider working with the company to get on a plan that allows you to cancel at any time.

- Next, determine the median household income in your area and divide it by four (or multiply it by .25). You can find the median household income for your state or even your town through the US Census Bureau’s Quick Facts pages here. Currently, one-quarter of this figure for the US equates to $17,255, but since this is not an exact science, you are welcome to round to the nearest $5,000. Let’s round up to $20,000.

- Next, write down your household’s annual gross income. That’s not the same as your paycheck, which is your net income. Your gross income is what your employer and the government say you earn each year. Include both incomes if you have a spouse or a partner.

- Finally, divide your annual income (step 3) by the figure in step 2 ($20k). Then, multiply it by the figure you came up with in step 1 (monthly survival expenses). This is your target emergency savings fund goal.

Here’s an example. Fred and Ginger live in North Hollywood, California (ZIP 91605). According to the US Census Bureau, the median household income there is $69,778. Fred and Ginger earn a combined $120,000 annually (gross). Their monthly survival and obligatory expenses equate to $6,000.

Step 1: $6,000

Step 2: $69,778 ÷ 4 = $17,444.50. We’ll round to $20,000.

Step 3: $120,000

Step 4: $120,000 ÷ $20,000 (6) x $6,000 =

$36,000

That’s a lot of money. Chances are that before you ever reach your household’s emergency savings goal based on this formula, you will need to use some of it for a household emergency. Such emergencies should include periods of unemployment or other times without income, like those due to medical crises.

With that possibility in mind, don’t get discouraged if the goal seems unattainable. Your emergency savings activities should revolve more around a commitment to regularly preparing for the possibility of future eventualities rather than a focus on any single amount.

Before moving on to short-term savings goals, let’s quickly answer the question you might have about where to place your emergency savings fund. After all, the interest you earn on savings accounts will rarely exceed, let alone equal, annual inflation rates. Keep in mind that saving for emergencies is not a wealth-building activity. Your goal is to have cash available when you need it, not build wealth. That’s a goal outlined further on in this post.

Certificates of Deposit work great for emergency savings, not only because they typically generate a little more interest (though not much) but also because they offer an incentive to avoid raiding the funds except in times of emergency. The small penalties most CDs carry (for example, the loss of a small amount of interest) can be enough to keep us from dipping into these funds for impulse purchases.

Short-term Savings Goals

Beyond the critical financial activity of saving for possible future emergencies, you should also be sure you’re saving for other future expenses, whether or not you know when they’re going to happen. Consider the following activities and situations that will require a significant amount of savings to avoid going into debt. They will almost certainly happen within the next one to fifteen years, even if you don’t know exactly when.

You might consider opening separate savings accounts for each of these short-term goals so you can track your progress. Otherwise, with all your short-term savings funds in one account, your human nature will kick in and tell you to use whatever is in the account for the next big purchase. You might also look for financial institutions that only require you to open one savings account but allow you to track separate savings goals within that single account.

Vacations

You might take a vacation every year, or you might take vacations every four or five years. Regardless, vacations typically require you to spend more money than you could come up with from a single paycheck. That means you will need to save over time to avoid using a credit card or other loan to go into debt for that vacation.

Instead of waiting until May or June to start saving for your July vacation, start as soon as you think about your vacation. The longer you have to save for it, the less you will need to set aside each month.

Next Vehicle

Too many consumers assume that car payments are a normal way of life. Unfortunately, I’ve worked with far too many households who get into financial trouble early in the car or truck loan because they lose their job or come on hard times and otherwise can’t afford their monthly car payment.

Unless you put a large amount down on the loan, you will be upside-down on your loan for the first two to three years. This is also sometimes referred to as being underwater. It means you won’t be able to sell the vehicle because it’s worth less than what you owe.

Instead, start now to save for your next vehicle. Or, if you still have a car payment, once it’s paid off, continue making those same monthly payments. But instead of sending that money to a finance company, deposit it into a savings account specifically for your next vehicle.

Gift Giving

Birthdays, Christmas, and other holidays come around every year, without fail. Yet most American households fail to prepare financially for the gift-giving associated with these days and seasons. Instead, they use a credit card, go into debt, and take six months or more to pay off the gifts they gave.

The next time you find yourself finally paying off your gift-giving credit card debt, keep making those payments, but instead of giving that money to the credit card companies, deposit it into a savings account meant just for gift-giving. Some banks and credit unions still have special “holiday” savings accounts that might offer a bit higher APRs. Others might have accounts that add a slight penalty (loss of some interest) if you withdraw money at any time other than between November 1 and December 31.

Appliances and Furniture

All major appliances and furniture will wear out, typically between 10 and 15 years. Rather than buying their replacements using a credit card, a store card, or, worse, a payday or pawn loan, save up for the purchase using a separate savings account for when the time comes.

For example, if your refrigerator is 10 years old, you probably have about five years before you will need to replace it. Granted, some will last 20 or even 30 years, but others will only last 5 or 6 years. Regardless, if you think you will spend $3,000 on your next refrigerator, that will give you 5 years (60 months) to save for it. $3,000 ÷ 60 = $50 per month. That might seem like a lot, but if you wait just another two years to start saving for that same refrigerator, you’ll have to come up with $83 per month. Waiting until the fridge has already started to hiss and buzz and sputter, giving you a one-year notice, you’ll need to come up with $250 per month to be prepared for its final demise.

Long-term Investments

Besides emergency and short-term savings goals, every household should also look for ways to secure their financial future by contributing to investment accounts. For most, this might involve a 401(K), a 403(B), or an Individual Retirement Account (IRA), which all involve tax advantages. For those wanting to invest in their child’s or grandchild’s education, a 529 account available through a state treasurer’s office might make sense and also offer more tax advantages.

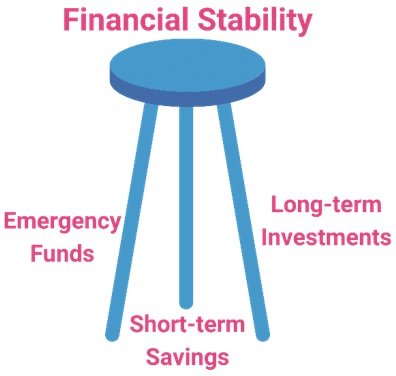

The Three-legged Stool of Financial Stability

Taken as a whole, emergency funds, short-term savings, and long-term investments place your household on a solid foundation that will withstand the financial storms of life, whether you know the forecasts or not.