How are Lottery Winnings Taxed?

Are you dreaming of winning the lottery and hitting the jackpot? We all know the thrill of imagining what we could do with all that cash – from traveling the world to buying a new house or car. But before you start counting your winnings, it’s important to understand the tax implications of hitting the lottery jackpot. That’s right, even lottery winnings are subject to taxes, which can put a dent in your grand plans for spending your newfound wealth. So, before you start planning your shopping spree, let’s take a closer look at what you can expect to pay in taxes on lottery winnings. Don’t worry, we’ll try to make it as painless as possible!

We share the important information below if you’re a lotto player or anyone who wants to know about the lottery and taxes. For example, imagine you’ve won the recent billion-dollar-plus jackpots!

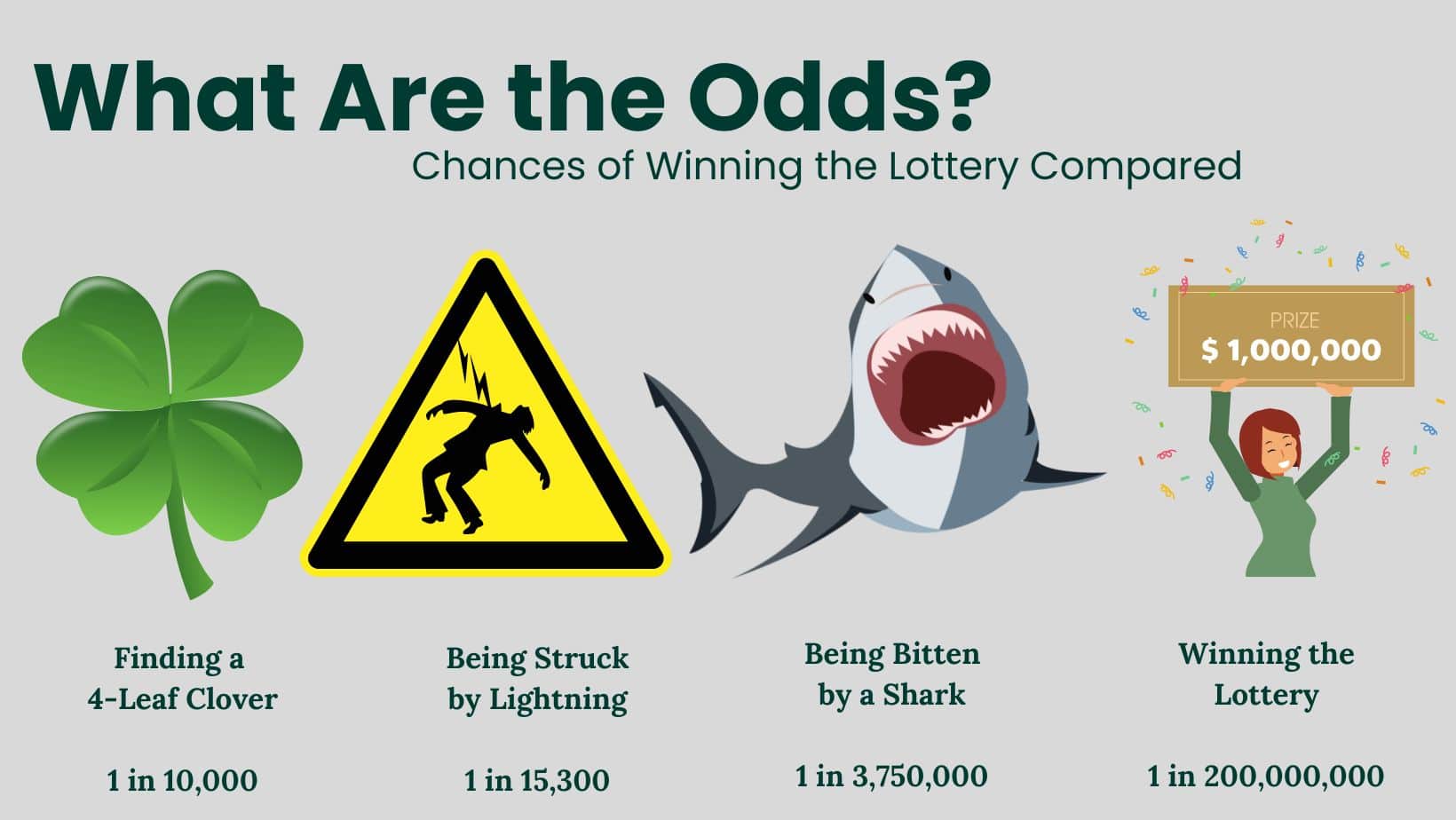

Chances of Winning a Lottery

Winning a lottery jackpot is the dream of many. However, winning is almost virtually impossible. The odds of winning a jackpot are estimated to be around 1 in 200 million. This means that if you play every single day for your entire life, you won’t be able to win a jackpot even once. The chances of you being struck by lightning are even greater than winning the lottery.

Factors That Affect Your Prize’s Taxes

- Total Winnings: Larger prizes put you in higher tax brackets, leading to a higher overall tax rate.

- State of Purchase: State tax laws on lottery winnings vary significantly, from none to over 8%.

- Personal Income: Your winnings add to your yearly taxable income, potentially pushing you into a higher tax bracket.

- Lump Sum vs. Annuity: Choosing a lump sum might mean a larger immediate tax burden compared to spreading payments over time with an annuity.

Important: Tax laws can be complex. Consult a tax professional to properly understand the tax implications of your specific lottery winnings situation.

How Do Taxes Work With Lottery Winnings?

US lottery taxes differ from other countries because winnings are considered taxable income for both federal and possibly state taxes. The federal government withholds 24% of your winnings immediately. You may owe additional federal taxes depending on your overall tax bracket.

Each state also has its own rules. Some states have income tax and will tax a portion of your winnings. Others don’t have a general income tax, but you’ll still owe federal taxes.

A few states have specific rules on taxing lottery winnings:

- California: Does not tax lottery winnings at the state level. Federal taxes still apply.

- New Hampshire and Tennessee: Don’t have general income tax, but they do tax interest and dividends. Lottery winnings are not subject to state tax in either state.

Five states don’t have lotteries: Alabama, Alaska, Hawaii, Nevada, and Utah.

Important: Always consult a tax professional for specific guidance on your lottery winnings, as tax laws can be complex.

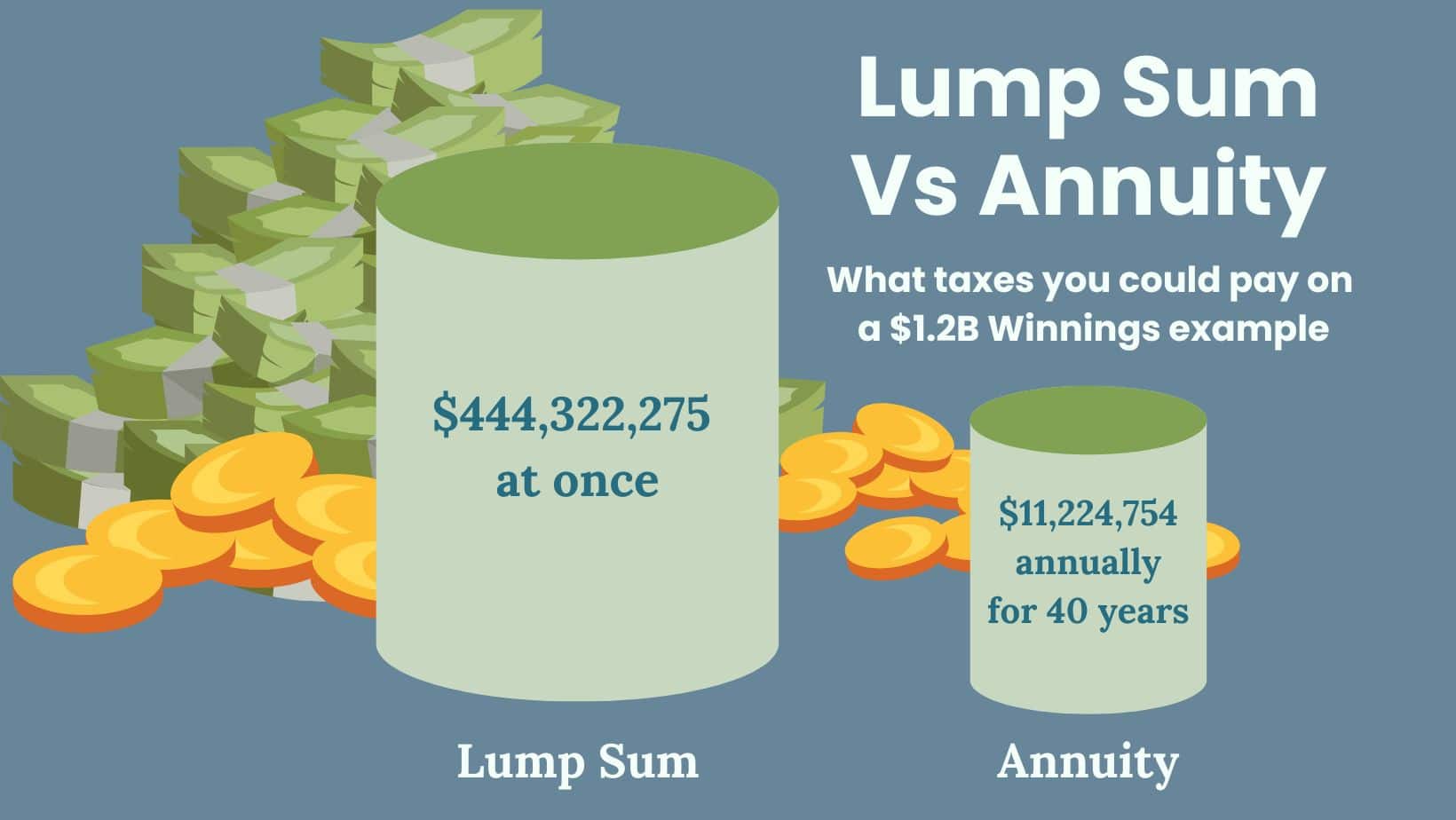

Taking a Lump Sum or Annuity Payments

Lump Sum

If you receive your lottery winnings as a single lump sum, you could be subject to the highest tax bracket for the current year. Your $1.2B winnings are over the set threshold for the top tax bracket ($539,901+ for single taxpayers and $647,851+ for married couples filing jointly) — so you could be taxed at 37%.

Therefore, if you’re single when you win $1.2B as a lump sum and have a taxable income of $50,000, your total income for the current year is $1,200,050,000. In this case, the part of your income that exceeds $539,90 will be taxed at 37%. Unfortunately, lower tax rates would also apply to portions of your income below that threshold.

For sample computations, here’s how it looks:

-

10% of your income up to $10,275 = 1,027.5

-

12% on the next $41,775 = $5,013

-

22% on the next $89,075 = $19,596.5

-

24% on the next $170,050 = $40,812

-

32% on the next $215,950 = $69,104

-

35% on the next $539,900 = $188,965

-

37% on the next $539,901+= $443,998,557

You could pay a whopping amount of $444,322,275 in taxes. However, if you look at the bright side, not the whole amount was taxed at 37% — only the amount that exceeds the set threshold.

Annuity Payments

On the other hand, if you want to avoid a hefty tax bill, consider splitting your winnings into annual payments. For example, let’s say you decided to take your prize annually for 40 years. This means you get $30 million per year plus your $50,000. It’s still a high amount, though. But, you can stretch your tax payment instead of paying at once.

Look at the difference below:

-

10% of your income up to $10,275 = $1,027.50

-

12% on the next $41,775 = $5,013

-

22% on the next $89,075 = $19,596.5

-

24% on the next $170,050 = $40,812

-

32% on the next $215,950 = $69,104

-

35% on the next $539,900 = $188,965

-

37% on the next $539,901+= $10,900,237

Instead of paying $444,322,275 at once, you only pay $11,224,754 annually! In this example, the jackpot is huge, so you still pay the top bracket. However, if it’s smaller, your tax bracket could go down.

Minimizing Your Tax Burden

Taxes on lottery winnings are unavoidable, but there are ways to potentially reduce the impact:

- Annuity Payments: Spreading your winnings with an annuity can mean lower annual taxes compared to a lump sum.

- Charitable Donations: Donate to qualified charities and deduct those donations from your taxable income (within the limits allowed by the IRS).

- Deducting Gambling Losses: You can only deduct gambling losses up to the amount of your winnings in that tax year.

- Gifting Winnings: Be aware of potential gift tax rules when sharing your winnings.

Important: Tax laws are complex. Always consult with a tax advisor or financial professional for strategies tailored to your winnings and situation. This article is not a substitute for professional advice.

Conclusion

While winning the lottery is always exciting, it’s essential to know that any US federal and state income taxes will still apply. If you win the lottery and are anxious about tax computation, you can ask for help from a professional accountant to do the job for you. This isn’t financial advice and you can visit https://www.irs.gov/taxtopics/tc419 for information regarding gambling income and losses directly from the IRS.

The reality is that for many, the lottery preys upon their dreams and ultimately does more harm than good for scores of individuals that are in a weak financial position.

Artwork created by Eric Lehtonen, a certified credit counselor at Money Fit.