Valentine’s Day Thoughts for Singles: The Anti-Valentine

The commercialization of romance and love leading up to February 14th can be enough to sour just about anyone on the day’s celebrations. If you are single and not in a romantic relationship, you may still find several reasons to celebrate the day, if for different reasons.

What can singles celebrate on Valentine’s Day?

Anyone not in a romantic relationship can still find joy on Valentine’s Day each year, celebrating money and time saved for personal priorities rather than feeling artificially forced into purchasing cards for or giving candies and bouquets to loved ones.

Debunking the Pessimism of Valentine’s Day

Many mistakenly believe that Valentine’s Day is the relatively recent creation of an American greeting card company, which would naturally add to the feelings of the day’s artificiality. If such were the case, it would be easily justified to hold both the companies and the holiday itself in contempt for mocking love, romance, and genuinely close relationships.

In truth, however, the origins of Valentine’s Day go back nearly 2,000 years when Romans celebrated Lupercalia in the middle of February as a festival of fertility.

Over six centuries ago, none other than Geoffrey Chaucer, author of the Canterbury Tales, referred several times to Valentine’s Day in his poem, The Parliament of Fowls, after which it became more common to refer to someone you love as a Valentine in February.

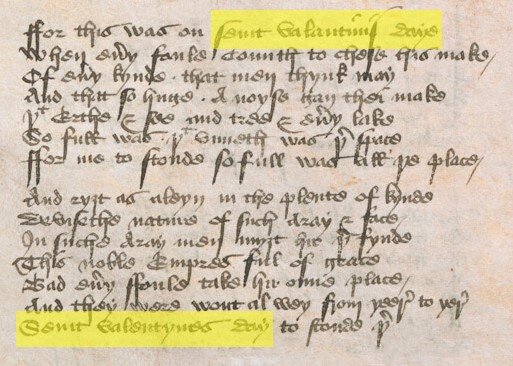

“For this was on Saint Valentine’s day, When every fowl comes there his mate to take, Of every species that men know, I say, And then so huge a crowd did they make, That earth and sea, and tree, and every lake Was so full, that there was scarcely space For me to stand, so full was all the place. And as Alain, in his Complaint of Nature, Describes her array and paints her face, In such array might men there find her. So this noble Empress, full of grace, Bade every fowl to take its proper place As they were wont to do from year to year, On Saint Valentine’s day, standing there.”

– Geoffrey Chaucer, The Parliament of Fowls

Just fifty years later, the Duke d’Orleans, imprisoned in the Tower of London, wrote his own Valentine’s poem to his wife in 1415.

As for Valentine’s Day greeting cards, Americans were sending their own homemade cards to each other as far back as the 1700s, centuries before the founding of any major greeting card company.

Celebrating Valentine’s Day Love If You Are Single

For some individuals who are not in a romantic relationship, Valentine’s Day might create feelings of loneliness or even rejection. Such emotions are common to the human experience in general regarding dating, love, even some marriages, and certainly divorces.

Although not meant as replacements for the strength and comfort that can be found in stable and loving relationships, the following ideas may help singles find something positive to celebrate on the day of roses and poems.

Celebrate Love with No Emotional Pressure

There is a strong cultural undercurrent to Valentine’s Day that is pushing back at its commercialization and the feelings of forced expressions of romance. The phrase, “If you love someone, shouldn’t you show them every day and not just on February 14” encapsulates this push back against the pressure to purchase a greeting card, buy and deliver flowers, make reservations at a highly-priced, upscale, and overcrowded restaurant, and buy tickets to popular movies, plays, and concerts.

If you are among a large number of individuals not in or even seeking to be in a romantic relationship, you can still celebrate Valentine’s Day knowing you have no such tensions pulling on your emotions this year.

Celebrate Love for Time Not Waiting in Line

Everyone who has ever taken their Valentine out to dinner on Valentine’s Day evening, particularly if the day falls on a Friday or Saturday, knows that standing in line and waiting for a table will take up a large part of the evening’s activities. Regardless of the reason, waiting in lines is no one’s idea of a fun time.

This year and any Valentine’s Day, singles can celebrate the fact they have 30 to 60 minutes of their life they need not stand in line next to 23 couples they have never met or plan to meet again. Time is a finite resource, so you have no need to waste it this year.

Celebrate Love for your Financial Priorities

Skyrocketing prices for roses, gift cards that now sing or tell jokes, meals at fancy restaurants, gifts from boutique shops, and treats from trendy bakeries can easily add up to hundreds of dollars in Valentine’s Day costs. Quite often, the spender had not saved for these expenses and paid for them with money that was meant for some other priority.

For singles, this means less money on credit cards and more money applied to top priorities. Money isn’t everything, but debt feels empty. Enjoy a fuller wallet this year.

Celebrate Love for Your Own Health

There is no end to the variety and amount of treats available for purchase on Valentine’s Day, few of which provide any necessary nutrition for our bodies. Additionally, dining out means being served a meal that can easily contain 100% to 150% of your daily calorie count on a single dinner plate, not to mention the dessert trolley passing your way.

While more and more healthy-fare restaurants are gaining in popularity, most couples are unlikely to choose them as a destination to celebrate their love.

This year and every year, singles can celebrate healthy eating at home or at a favorite healthy destination eatery.

Celebrate Those You Love

Singles can easily celebrate their love for those in their lives they truly appreciate and care for. While Valentine’s Day still carries more than a strong hint of romance, it is both perfectly acceptable and perfectly normal to express Valentine’s Day wishes to close family members and friends.

If so inspired, singles can just as well mail greeting cards, send emoji-laden text messages, post-Valentine’s Day love messages and offer other expressions of love and appreciation to those in their closest circles. Sending and receiving such manifestations of love and concern lift the hearts of all involved, regardless of the date.

Celebrate Those Who Love Each Other

Most singles and those who have been single do not begrudge those who celebrate Valentine’s Day with a special someone. Wishing couples joy and happiness on Valentine’s Day is a great way to strengthen bonds in families and among friends.

Even for those who may wish for a romantic relationship to celebrate on Valentine’s (and admittedly not all singles do), sending expressions of thoughtful hopes for happiness never falls on the wrong day of the year. In fact, a study released in 2019 found that wishing others well have a positive effect on the well-wisher’s own emotional state. Among the positive consequences of wishing others happiness are greater feelings of connectedness, greater happiness, and lower anxiety.

So, go ahead and make your own day by wishing a romantic couple a happy Valentine’s. It’s not selfish. It’s nature’s way of spreading cheer to all who want to participate.

Happy Valentine’s to the Anti-Valentine’s Crowd

Given the debunking of the theory of Valentine’s artificial origin as well as the positive effects anyone can gain from celebrating love on February 14th, shouldn’t you reconsider your feelings toward the day? While you certainly need not spend money on cards, flowers, and meals you feel are not authentic to the way you feel, offering wishes of happiness and love to couples on Valentine’s Day may just turn out to boost your own positive emotional well-being.

Happy Valentine’s Day to all!