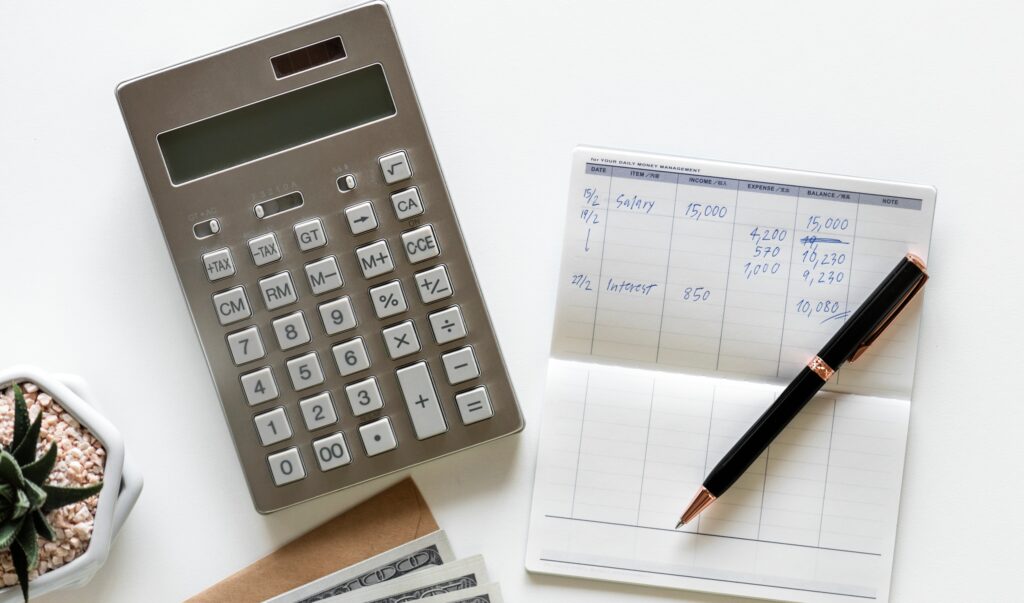

Fixed Expenses Can Simplify Your Finances

All personal and household expenses belong to one of three expenditure categories:

-

Fixed

-

Variable

-

Periodic

If you are wondering why you should care, it really does matter which type of expenses you have in your budget.

The more fixed your expenses are, the better. The more periodic your expenses are, the more financial crises you will likely experience.

What are Fixed Expenses?

A fixed expense reoccurs every month in the same exact amount.

Fixed expenses typically include your largest financial obligations and they cause the fewest problems. The regularity of fixed payments leads you to expect them and plan for them.

Examples of fixed expenses include:

-

Rent or Mortgage

-

Monthly car payment

-

Insurance premiums

-

Prepaid cell phone

-

Internet/TV bills

Even though fixed expenses typically cause less stress than variable and periodic expenses, you may still benefit from one simple trick to reducing your worry even further about taking care of them.

TIP: Automate

Automating your fixed expenses takes the hassle out of monthly bill paying. Pay your rent, mortgage, utility bills, car payments, phone bills, and other fixed bills automatically by using one of the following options:

-

Set up a reoccurring direct debit transaction with the merchant or creditor. By providing them with your bank or credit union’s routing number and your account number, you make the merchant or creditor responsible for “grabbing” your payment on its due date. If your payment due date falls on a weekend or holiday, they usually draw the payment the following workday. If they process the payment late, you are not responsible for any late fees.

-

Provide the merchant or creditor with a payment card for your monthly transactions, whether it be a debit, credit, or prepaid card. You will need to update the card information whenever the number or expiration date changes, but this method also simplifies your monthly payments. Similar to direct debit, providing one of these payment methods means the responsibility for drawing the monthly payment on time falls on the merchant and creditor, not you.

-

The final option involves setting up automated bill payments through your bank or credit union. Whereas the first two options involve the merchant or creditor “pulling” your payment from your account, this method involves you “pushing” the payment out of your account. Most banks and credit unions offer online bill pay for free, and you can use it to pay virtually anybody for any reason just about anywhere in the country. It comes with a downside, though. You must schedule the payment well in advance of the due date. Then, you must rely on either your bank or credit union and the US Postal Service to deliver the payment on time. If the payment arrives late, you will be responsible for any late fees.

What are Variable Expenses?

A variable expense occurs every month but the amount changes. The changes in amounts due can lead to problems with your bank account balance.

Still, because they happen regularly, variable expenses rarely cause catastrophic problems. Their regularity means you remember and expect them and generally have an idea of how much they are going to be.

However, when the amount owed or spent on a variable expense fluctuates significantly from one month to the next, even when expected, it can lead to a cash shortage in your checking account.

Examples of variable expenses that can change significantly from month to month include:

-

Electric bill

-

Groceries

-

Gasoline

-

Entertainment, dining out (your “fun money”)

What are Periodic Expenses?

A periodic expense occurs infrequently or just once. It may be expected or unexpected.

Due to their infrequent nature, periodic expenses generally cause individuals and households the greatest financial trouble. Even if you expect the expense every few months or a couple of years, you likely forget about it until it becomes necessary to address it. Unexpected periodic expenses are typically the least welcomed of all, mostly because they involve emergencies and require you to spend large amounts of money to address.

Examples of expected periodic expenses include:

-

Christmas or birthday gifts

-

Vacation and travel

-

Vehicle maintenance

Examples of unexpected periodic expenses include:

-

Medical emergency

-

Vehicle repair or replacement

-

Appliance, furniture, and electronics repair or replacement

The Keys to Turning Variable and Periodic Expenses into Fixed Expenses

If you could turn your variable and periodic expenses into fixed expenses, why wouldn’t you? Fixed expenses may be boring, but boring is good when it comes to money. Life is exciting enough already.

From Variable to Fixed Expenses

Turning variable expenses into fixed expenses may seem impossible or, at least, like a lot of work, but the following tip is all you need.

TIP: Plan

Fixing your electricity bills may bring up visions of monitoring power usage, patrolling your bedrooms for lights left on unnecessarily, or even drying your clothing on a clothesline. Actually, the solution is much simpler. If you have lived in your home or apartment for a year or more, most electric companies offer monthly payment plans that “level” your monthly amount due.

Simply put, the electric company averages your monthly bills over the past year and charges you that amount every month going forward. If, after a year, they need to adjust your payment (which is often the case), they will do so. In the meantime, though, you know exactly what to budget for your electric bill every month. It is fixed. No more unpleasant, late-summer surprises after your A/C has kicked in.

You can perform the same magic trick with most home heating utilities, including natural gas and even home heating oil companies. Most do not charge additional fees for this service, though some do charge extra for processing debit or credit card payments. Still, the utility company does all the monthly planning for you.

Other variable expenses require a bit more planning on your part. Start with your grocery bill.

It is virtually impossible to spend the exact same amount of money every month on groceries without a plan. Even if you were to purchase the same foods in the same amounts at the same stores every month, food prices change.

The solution is much easier. Simply set a monthly spending limit for your groceries and stick to it. Also known as budgeting, setting a spending amount on your groceries forces you to curtail extra and unnecessary spending at the local markets. The amount you set for spending is up to you, but the key is to stick to it.

You can easily do the same sort of planning with entertainment and dining out. Set a monthly limit and stick to it. By doing so, you have “fixed” another variable expense. If you don’t use all of your entertainment or dining out money for the month, consider either rolling it over to your entertainment and dining out money budgeted for the next month or adding it to a savings or other financial goal.

Gasoline might seem like an exception because of the daily price fluctuations and changes in your driving habits. However, establishing a realistic monthly gas budget and sticking to it can “fix” your gasoline spending as with other variable expenses.

Keep in mind that gas prices typically rise between 20% to 50% between late winter and mid-summer. Consequently, your fixed gasoline budget will need to reflect such seasonal fluctuations. Any gas money you do not spend in the fall and winter months can be set aside to use during the higher price seasons of spring and summer.

From Periodic to Fixed Expenses

Turning periodic expenses into fixed expenses sounds like an even more difficult magic trick, but here is another four-letter word tip.

TIP: Save

By saving monthly for expected and unexpected future expenses (appliances, medical emergencies, car repairs, vacations, etc.), you turn troublesome periodic expenses into easy-to-remember fixed transfers. Here are the simple steps:

-

Commit to saving a specific amount of money each month for unexpected expenses. This is your emergency fund, and you should generally only use it during times when you have no income or insufficient income to survive.

-

Make a list of your expected periodic expenses. Your list might include gifts for birthdays, anniversaries, and holidays; vacation and travel; vehicle maintenance and replacement; repair and replacement of appliances, furniture, and electronics; home repairs that might include furnace, A/C, water heater, and roof; education costs; fees for clubs and activities, to name a few. When you have made your list, you will likely feel overwhelmed, but stick with it. Most of these expenses are coming, whether you plan for them or not. Being prepared will eventually provide you with wonderful peace of mind.

-

Estimate as best you can when you will need to spend money on each periodic expense on your list. Some are easy, like gifts and vacations. Your predictions for other expenses will be understandably less reliable, such as those for when you need to replace appliances and electronics. Still, a simple browser search for “life expectancy of a refrigerator,” for example, will give you an idea of how long you have before you should expect to replace or repair each item.

-

Determine the replacement, purchase, or repair cost of each item on your list. Your preferences and tastes differ from those of your neighbors, so these costs will be different for everyone.

-

Using your answers from #3 and #4 above, calculate how much money you will need to save each month for each item in order to be best prepared.

-

Consider setting up separate savings accounts for each listed in #2 above – or use a savings program such as SmartyPig.com – to keep your growing periodic expense funds divided. This will minimize the likelihood of you raiding one fund to use for another, often less important purpose.

In summary, your three-step process to simplifying and de-stressing your financial bills includes:

1. Automate your fixed expenses

2. Make a plan to turn your variable expenses into fixed expenses

3. Save for your periodic expenses

Convert as many variable expenses as possible to fixed expenses through planning and through contacting merchants. Additionally, convert as many periodic expenses as possible to fixed expenses by determining how much money you should be saving each month to be prepared for when the periodic expense occurs.

You will not likely enjoy paying your fixed monthly bills. It is not meant to be thrilling, but you will know exactly how much you have to pay and when to do so. Of course, when it comes to paying bills, no one wants an end-of-the-month cliffhanger. As far as money goes, the more boring the better.

In a perfect world, using the methods above will leave you just one stressful financial decision to make regularly: How am I going to spend my fun money this month? Now that is stress most of us enjoy facing.